We have talked a lot about the “wheel” strategy over the past couple of weeks in MTM’s Group Coaching class. In class, we have been carefully following 5 stocks and the S&P 500 ETF (SPY). But for this blog, we will look at one stock in particular: Apple Inc. (AAPL). If you are not familiar with the wheel strategy, let’s take a closer look and explore how it may help you in a big way as an investor.

The Wheel Strategy

Keeping the explanation simple, the wheel strategy is selling a cash-secured put (having funds in your account to cover the potential purchase of shares) and either getting assigned the position (100 shares of stock per put) or having the put expire worthless if it closes at or above the put strike at expiration. In addition, you can always buy back the put option when its value has decreased a fair amount.

If assigned, the investor will then sell a call (covered call) usually above where the stock is currently trading and where he or she was assigned the shares (short put strike). If the underlying remains at or below the short call strike, the call expires worthless. Like the short put, the call can be bought back when the value of the call premium has decreased a fair amount. If the underlying closes above the short call strike, the 100 shares would be sold at the call strike and would leave the investor with no position. The investor keeps the short call and put premium at expiration unless it was bought back ahead of expiration.

Wash, Rinse, Repeat

Guess what happens next if desired? The investor can start the whole process over again by selling a cash-secured put, usually below the underlying price of the shares. Hence, that is why it is called the wheel strategy. It is simple and can be quite effective. There are a lot of nuances to this strategy, which we’ll get into in another post.

AAPL Example

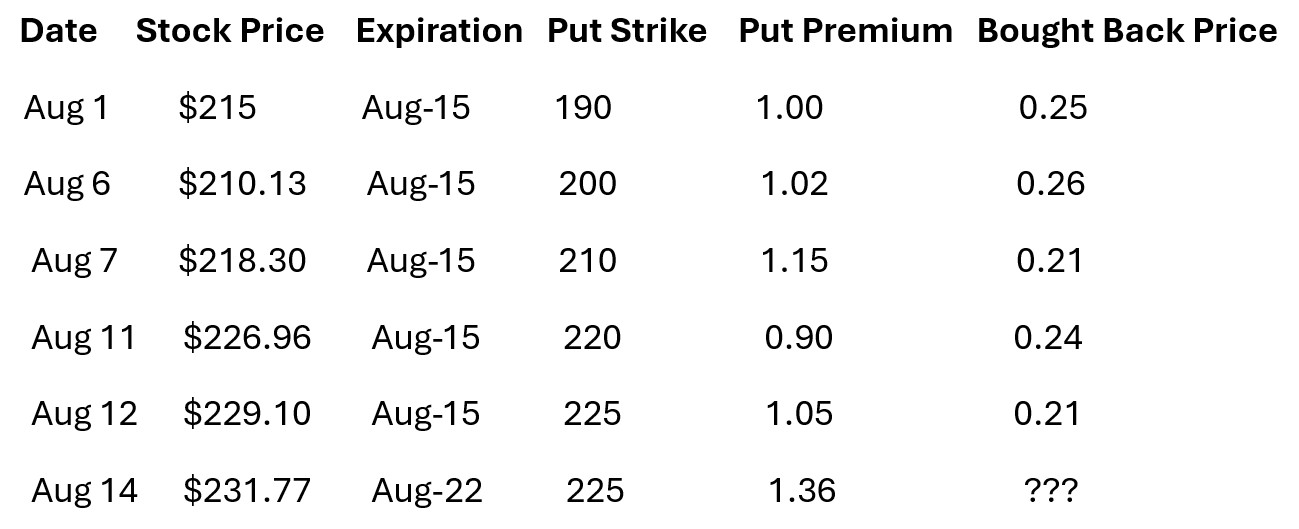

AAPL, as I mentioned, is one of the stocks we have been following in class. Below is the log of our recent trades. We have not been assigned thus far because AAPL has either held its ground or moved higher. We have bought back the cash-secured put every time thus far, except for the current short put as listed below, which was initiated Aug. 14.

The Results

As you can see from our results, we bought back all the short puts for significantly less than what we sold them sold for. At the time of this writing, we had realized a profit of $395. At some point, shares will be assigned when AAPL closes below the short put strike at expiration. But here’s the thing: An investor can use that previously accumulated premium to help offset any potential decline in the stock. It is like lowering the breakeven on the position.

In Conclusion

As an investor, the wheel strategy can be a big help in growing your account. It does involve having a bigger account in case the shares are assigned, which can eliminate those traders and investors with smaller accounts. For me, it has opened my eyes as an option trader/investor to possibilities that I did not know existed before this simple strategy.

John Kmiecik

Senior Options Instructor

Market Taker Mentoring