Not sure you have noticed, but shares of GLD (SPDR Gold Shares) are up big along with the price of gold. This of course, is not a surprise. The GLD ETF can also be quite volatile. Let’s take a look at how we played this several times over the past few weeks in MTM’s Group Coaching class.

The Setup

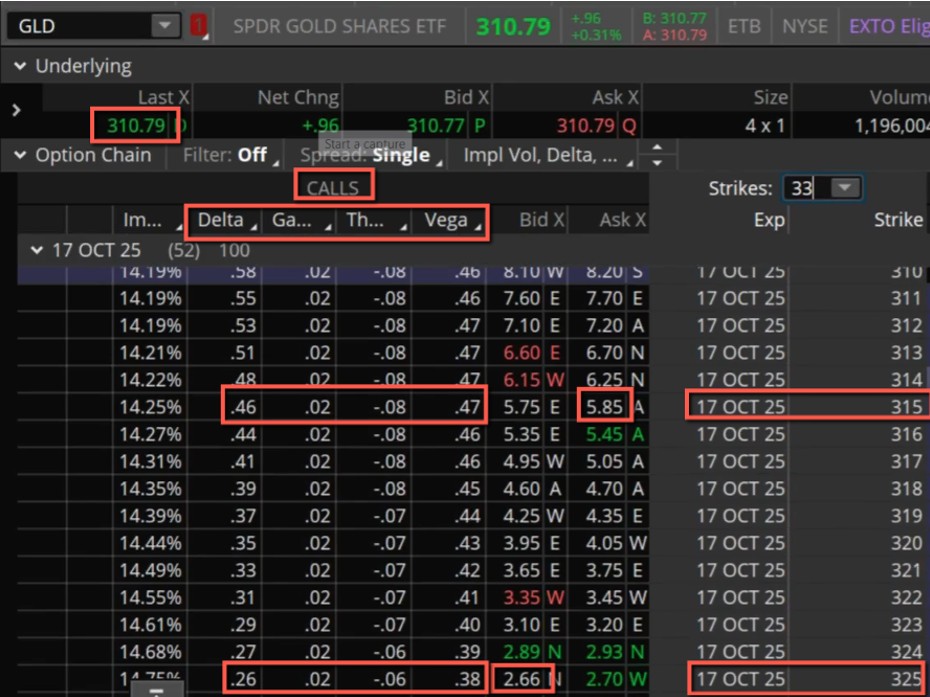

Expecting a move higher based on technical analysis and news, we considered a bull call spread on GLD. Generally, I like to say you should match the expiration for the spread to the expected move. The further out to expiration you go, the more you mute the option greeks, especially delta. Delta gravitates toward 0.50 the further to expiration, which means a spread further out in expiration, all things held equal, will have a smaller delta. Take a look at the option chain below on Aug. 26 when we entered this bull call.

The spread was $10 wide, and we went out-of-the-money just over $4 from where the underlying was trading with just over 50 days to go until expiration. Buying both the long and short call OTM reduced the cost of the trade and increased the risk reward compared with a bull call where the long option was at-the-money. We entered the trade as seen below at 3.15. The delta was approximately +0.20 (0.46 – 0.26) and theta was about -0.02 (0.06 – 0.08). Time, at least for now, was not much of a factor.

The Trade-Offs

There are a couple of trade-offs versus a shorter expiration. The delta would have been greater, meaning a higher move would have resulted in a bigger profit based on the risk. On the flip side, a volatile underlying would have benefited with a longer expiration and a lower move. It still would have lost value, but it would have been a smaller amount with a smaller delta with the longer expiration. The longer expiration can neutralize theta as well. It is less of a factor when there is more time to expiration. In this case, it gives a trade a little longer for the spread to possibly move higher, although we did not need it.

3 Weeks Later…

Looking at the position almost 3 weeks later, the position could have been sold for 8.75 as seen below. That is a profit of 5.60 (8.75 – 3.15) on a $315 investment. Could the position have done better with a shorter expiration? The answer is, absolutely, yes. But without knowing GLD was going to rally higher in a big way, we decided to take the trade-off of a smaller delta and theta counting on a more volatile move higher, which did not exactly materialize in those 3 weeks.

Final Thoughts

When you cannot decide on an expiration for your vertical debit spread, defaulting to a longer expiration will decrease and help neutralize all the option greeks. The two most important greeks, in my view, are delta and theta. This might allow you to manage your position without worrying about a smaller adverse move that might knock you out of the position if a shorter expiration had been chosen.

John Kmiecik

Senior Options Instructor

Market Taker Mentoring