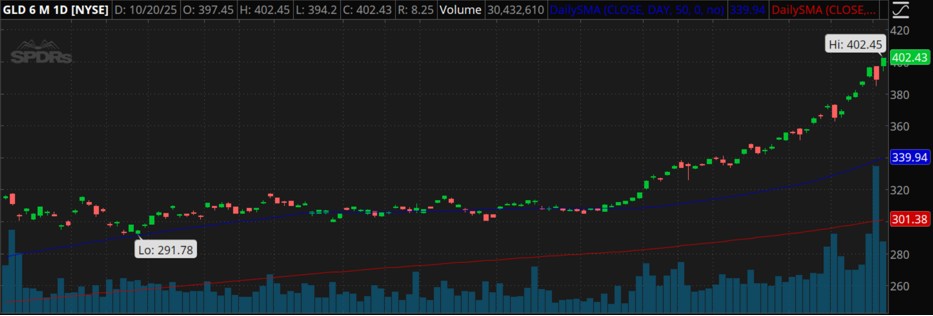

Gold prices seem to keep setting record highs each week, and we’ve been jumping on the bandwagon in MTM’s Group Coaching class, where we regularly look at GLD (Gold ETF). Over the past several months, we have modeled out several bull call spreads to capture the move higher. Needless to say, those spreads have done extremely well profit-wise – with the proper management I stress in class. Look at this recent 6-month daily chart of GLD.

You can see why those bullish spreads have done well because the ETF has continued to move higher. In fact, it was up more than $13 on this particular day, setting another record high. And check out this IV (implied volatility) chart.

You can see the red line (IV) is at its highest level in 6 months, meaning GLD option prices are more expensive. In class, we talked about selling cash-secured puts for those interested in possibly owning shares of the ETF and writing covered calls for those who own shares of the ETF. The more premium the better as a seller, and it seems like a good time to take advantage of what the option market is giving us.

Will Gold Continue to Rise?

Nothing is for certain but when interest yields slip, gold becomes more attractive. And because gold is priced in U.S. dollars, a weaker dollar helps. Gold has soared because of economic uncertainty, which seems likely to continue. Plus, many experts and institutions have raised their target rates to more than $5,000 an ounce over the next year or so.

Final Thoughts

If you are asking yourself whether it is too late to jump into gold, of course no one can answer that for sure. Clearly, it will pull back at some point and may even have already done so since the time of this writing. That said, it will move higher again at some point, with or without a pullback. As option traders/investors, we have vertical call spreads we can purchase and currently higher priced options to sell to try it reduce the risk if it falters. Just remember to always have a management plan in place.

John Kmiecik

Senior Options Instructor

Market Taker Mentoring