If you have heard me talk, you know I love both bull calls and call calendars. I am a big advocate of vertical debit spreads as well as long calendars for neutral and directional opportunities. But I am often asked, “should I do a bull call or directional call calendar when I am expecting a move higher?” Let’s look at a few points to consider.

The Pros and Cons of Each

Like most things when it comes to comparing options trading, there are several trade-offs. But one that could go either way is the risk-reward of the trade. Depending on the strike prices and expirations, either spread could have an advantage.

Depending on the spread, the directional calendar will usually have a breakeven that is lower than the bull call spread. The bull call will usually need a move higher, but because of potential positive theta, a call calendar usually has the advantage. Let’s consider a potential scenario on Boeing Co. (BA). Look at the chart below. Let’s pretend an option trader thinks the stock will rally up to $210 by next week’s expiration (Nov 14th).

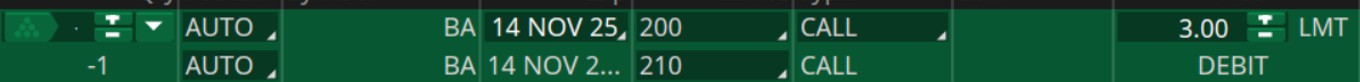

He could choose to buy a Nov 14th 200/210 bull call spread as seen below.

That means he bought the 200 call and sold the 210 call for a debit of 3.00. That is the max risk suffered if BA closes at $200 or lower at expiration. Max profit is 7.00 (10 -3) and is realized if BA is trading at $210 or higher at expiration. Breakeven is $203 (200 + 3) at expiration.

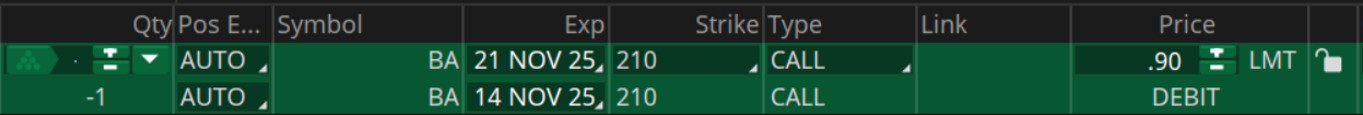

He could also choose to buy a Nov 14th/Nov 21st 210 call calendar as seen below.

That means he sold the Nov 14th 210 call and bought the Nov 21st 210 call for a debit of 0.90. That is the max risk and is much less than the bull call at 3.00. The max profit and breakevens are not exact and are guesstimates because of 2 different expirations (Nov 14th and Nov 21st). The P&L diagram at the short expiration looks like this (see below).

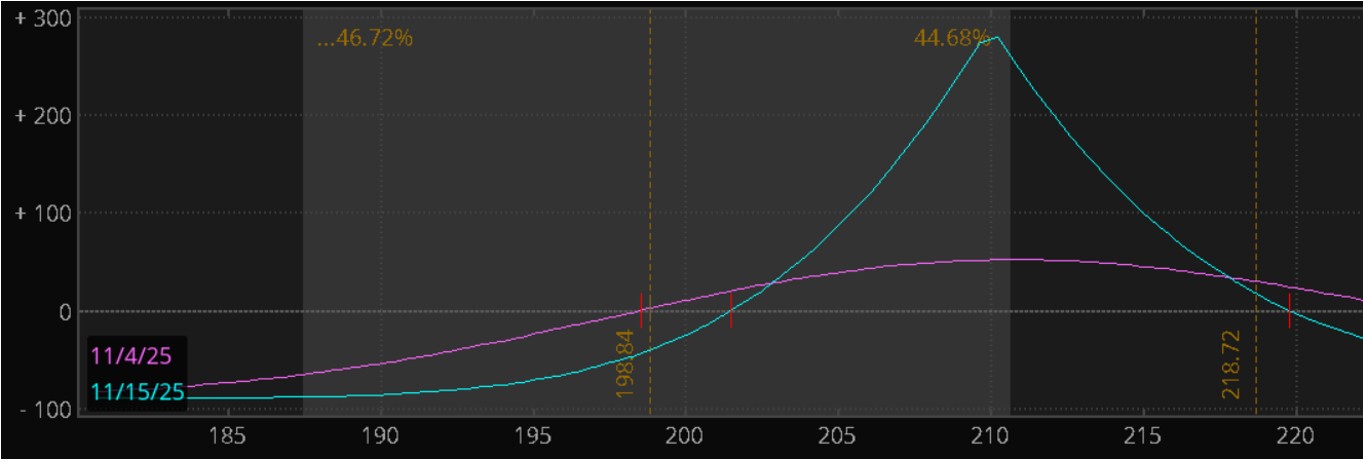

The max profit is estimated to be just below $300, and the breakevens are around $201.50 to the downside and just short of $220 to the upside. That max profit is earned at the short strike’s expiration. A profit can be made but it would be less away from the $210 level. The bull call spread is defined and much more but with greater risk. Although the breakeven is an estimate for the calendar, it is lower than the bull call.

The other glaring difference you have probably noticed already is that it does not matter how high the stock goes for the bull call. Anything at or above $210 at expiration will yield a profit of 7.00 ($700 in real terms). The calendar has an estimate for a breakeven but can actually lose money if the stock goes too much higher.

Final Thoughts

I cannot lie to you; it is sometimes a difficult decision to decide which spread to do. Clearly there are different risk/reward scenarios and expectations from the underlying to take into account. If you do that, you should have a more educated guess on which one would be the better choice. Good luck!

John Kmiecik

Senior Options Instructor

Market Taker Mentoring