I often say to student traders that just because I don’t trade a particular underlying or strategy does not mean you shouldn’t trade it or at least experiment with it. A call back spread is a perfect example of a strategy I rarely trade. I have not done one in years, partly because other strategies come to mind first. Let’s take a quick look at when and why you might consider a call back spread.

What Is a Call Back Spread?

Sometimes called a ratio call backspread, a call back spread consists of selling one or more lower strike call options (usually around the money) and buying more higher strike call options (usually out-of-the-money). With more long than short calls, an option trader has unlimited profit potential. A trader would consider a call back spread when he or she is expecting a big move higher. As with most option strategies, risk and the initial outlay of capital can be limited.

NVDA Example

Let’s say an option trader has been watching NVIDIA (NVDA) and she thinks eventually it will move higher off its 50-day moving average, as seen below, and move up after its earnings announcement.

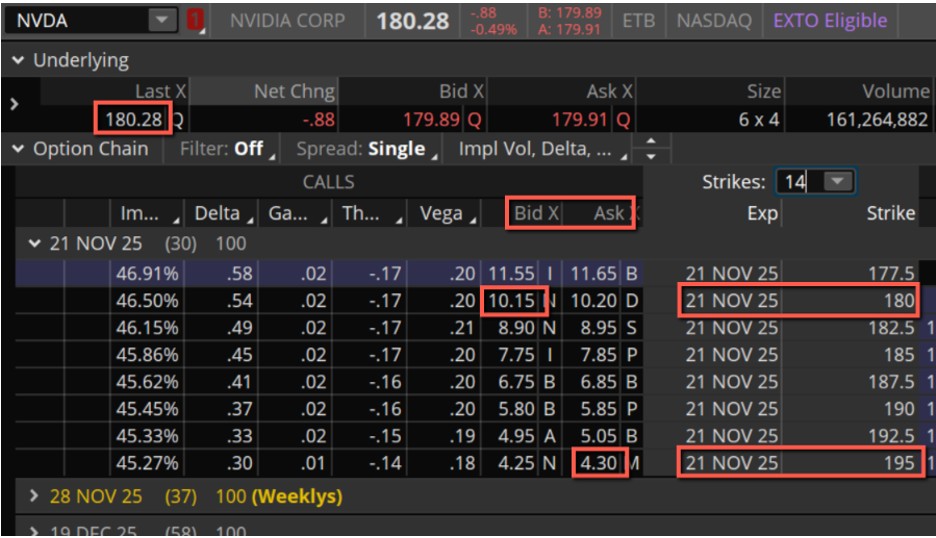

With the stock around $180, she can sell the 180 strike for 10.15 and buy 2 of the 195 strike calls for 4.30 apiece. This gives her a credit of 1.55 (10.15 – (4.30 X 2)) as seen below.

Now here is where it can become a little complicated. There are two breakevens on this trade at expiration. To the downside it is $181.55 (180 + 1.55), which is the short call strike plus the credit received. Anything below that level at expiration results in a small gain. The breakeven to the upside is $208.45 (210 – 1.55), which is adding the strike difference (195 – 180) to the short strike and subtracting the credit received. There is relatively a long way to go to move above the upside breakeven by expiration, but the max profit is infinite. The stock needs to go crazy to the upside or move lower for this spread to be profitable.

Final Thoughts

The call back spread can be a very useful tool in an option trader’s arsenal. The pros of the spread are that you have unlimited upside profit and limited risk, and it can be done for a net credit. On the con side, you need a big move higher and there is a chance of a loss with just a moderate move higher. Option traders should experiment with the spread and find out if it is worth it to them to consider it as a potential option to trade. Good luck!

John Kmiecik

Senior Options Instructor

Market Taker Mentoring