Recently, I discussed a strategy I do not often do as an option trader: the call back spread. Today, I’ll talk about its bearish complement: the put back spread. Let’s dive right in!

An option trader would consider a put back spread if she is expecting a relatively big move lower. The strategy can limit risk if the underlying does not move lower, but it benefits from a large move lower. It is generally a debit position or a slight credit depending on strike and expiration choices. A put back spread consists of selling a put (at or slightly in-the-money) and buying 2 puts (usually out-of-the-money). With more long than short puts, the maximum profit potential is big and down to zero for the underlying.

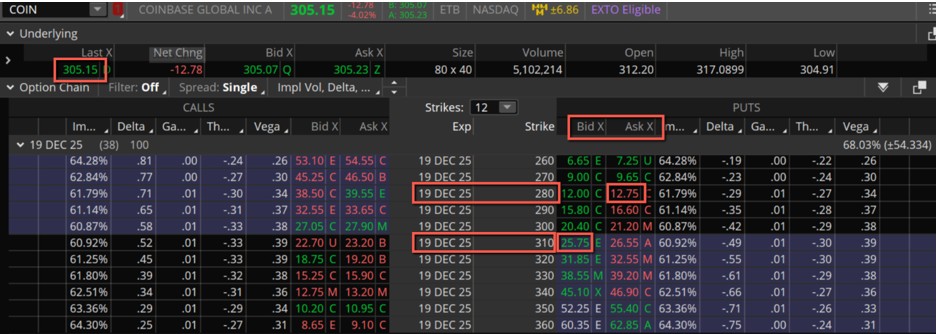

COIN Example

Let’s say an option trader believes Coinbase Global Inc. (COIN) will move vastly lower over the next month or so. She believes it might come down to a pivot low around $235.

With the stock around $305, she can sell the 310 strike put for 25.75 and buy 2 of the 280 strike puts for 12.75. After she middles the market, she brings in a credit of 1.00.

If COIN does not move lower and in fact moves higher, specifically over $310, she will keep the credit of 1.00 ($100 in real terms) because all the options would expire worthless. The breakeven to the downside is $251. It is derived from subtracting the difference in the strikes, which is $30 (310 – 280), from the short put strike (280 – 30) and then adding the $1 credit (250 + 1). The breakeven to the upside is $309 (310 – 1), which is subtracting the $1 credit from the short put strike. There is relatively a long way to go down to get past the breakeven to the downside, so a big move lower is needed but the profits can be potentially insane. A move lower sooner rather than later can also be very beneficial.

Final Thoughts

Just like the call back spread, the put back spread needs a decisive move and, in the COIN example, a big move lower. If you consider this spread, comparing it with other option spreads is a good idea. As always, there are pros and cons to each. Good luck!

John Kmiecik

Senior Options Instructor

Market Taker Mentoring