I was teaching MTM’s daily group coaching class on a recent Monday morning, when I saw something weird. In fact, at first I thought I was seeing things. There were options expirations on Apple Inc. (AAPL) for Monday, Wednesday and Friday for the following week and beyond. When I explored a little further, I found AAPL wasn’t the only.

Turns out the Options Clearing Corp. added AAPL, META, AMZN, GOOGL, TSLA, MSFT, NVDA, IBIT and AVGO to the list of underlyings that now have options expirations on Monday, Wednesday and Friday. All of them already had expirations every Friday, but now they have two more for the week. Well, this definitely gives us option traders more options! I am particularly excited because I love time spreads, and these new options give me more flexibility as a long-time spread trader. Let’s look at an example.

NVDA Example

At the time the new expirations were added, most of the companies were announcing their quarterly earnings either that week or the following week. NVIDIA was not. So, I looked at a double calendar in the middle of the week where I was selling Friday’s expiration and buying Monday’s expiration. Below is the daily chart.

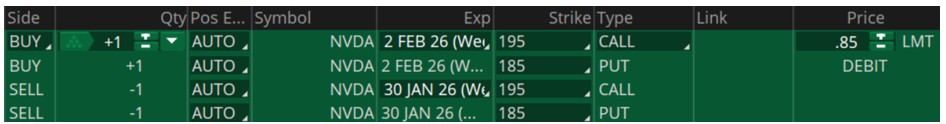

I wanted to give the stock a little leeway around the $191 level it was trading at, so I modeled out a long 185/195 Jan-30/Feb-02 double calendar. I was selling the 185 put and 195 call for Friday and buying the 185 put and 195 call for Monday (as seen below) for the cost of 0.85, or $85 in real terms.

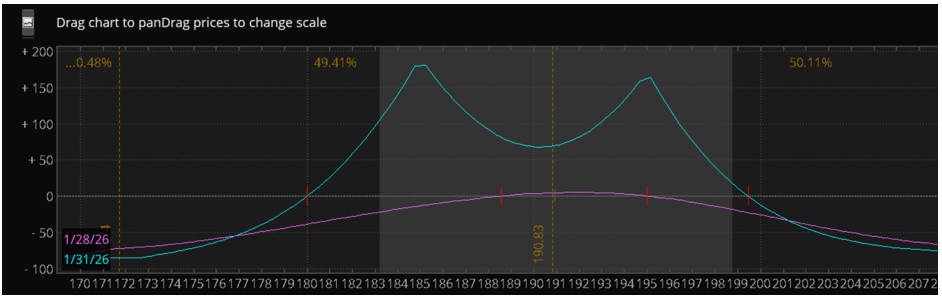

The max risk was that 0.85 and the max profit would be earned if miraculously NVDA closed at either $185 or $195 at Friday’s close. I was not counting on that to happen but thought it could wind up somewhere in that in area. Take a look at the P&L diagram at the time.

Besides a generous max profit at either $185 or $195, the guestimate breakevens went from about $180 to about $199.50. That’s an almost $20 spread. The breakevens and the max profits are guestimates because the time spread has 2 different expirations and there will be changes in time (theta) and changes in implied volatility (vega). The P&L diagram will change throughout the trade, but it should not change dramatically, barring a huge volatility event and considering that earnings were not for another several weeks at the time.

Final Thoughts

Having more options and strategies to consider as an option trader is a good thing. Having new and multiple expirations on some of the most heavily traded options can be a great thing. I will be looking especially to capitalize on Friday/Monday long calendars and double calendars and will keep you posted on my journey. Happy trading!

John Kmiecik

Senior Options Instructor

Market Taker Mentoring