CapEx Wrecks

Markets slipped after strong earnings but cautious guidance. Microsoft’s higher-than-expected AI CapEx raised fresh questions about spending, timing, and the AI buildout. Nvidia and other tech names felt the ripple.

More Expirations Mean More Options

New Monday and Wednesday option expirations on major stocks expand flexibility for option traders, creating fresh opportunities to deploy time spreads and calendar strategies around price and volatility.

Following Up on Yesterday

Yesterday’s follow-through above the 21-day MA has mostly played out, but the market still pushed to new highs.

AAPL, Silver & MU

Apple bounced off a major support level today with RSI signaling an oversold rebound. Silver surged on heavy volume but saw intense back-and-forth action, while Micron showed signs of slowing after an extended run.

This Stock: Up Over 60% This Year

A stock that stands out is Energy Fuels (UUUU), which has had a big start to the year on renewed interest in nuclear and rare earths.

Ambiguity Leads to Apprehension

Ambiguity increases volatility. Thus, traders become apprehensive and lack confidence when taking positions.

Volatility Fundamentals

Comparing implied vs. historical volatility helps determine whether options are relatively cheap or expensive.

Trading Naked

Naked options mean selling calls or puts with no protection. The upside is limited. The downside can be massive.

Waiting on the Close

Waiting for a bullish or bearish close—especially near key levels—can improve trade timing and tilt the odds in your favor for the next trading session.

What Is High-Frequency Trading?

High-frequency trading sounds intimidating, but it’s really a completely different game than position trading.

Always Watch for This

Your biggest trading cost isn’t commissions. It’s slippage. Wide bid-ask spreads and low volume can quietly hurt execution.

ADX, the Average Directional Indicator

ADX measures trend strength, not direction. If price rises while ADX falls, the trend may be weakening. If price and ADX rise together, the move may have more fuel.

Answer the Right Questions

If you address these questions before each trade, you will begin to think like a professional.

This Tipped Me Off

Early, heavy options activity from large traders signaled bullish momentum and helped explain the S&P 500’s move to new all-time highs.

Economics of Venezuela

Venezuela has massive oil, gold and rare earth reserves, but years of poor infrastructure mean uncertainty dominates near term pricing.

$10,000 Gold?

Gold has been a standout this year as central bank buying continues to rise while supply stays relatively stable.

Better Than Gold

Silver prices are soaring, outperforming gold as industrial demand, supply deficits and safe-haven buying collide.

Finding Bargains

Year-end tax-loss selling and light news flow pushed stocks slightly lower, creating opportunities to find solid companies trading at temporary discounts before the calendar turns.

Gold and Commodities

Rate-cut talk into a strong economy puts commodities in focus. Gold hit another all-time high, with global buying playing a big role.

Santa Claus (Rally) Is Comin’ to Town

Volatility remains unusually low despite rising concerns in AI stocks, suggesting heavy option selling may be masking underlying market risk.

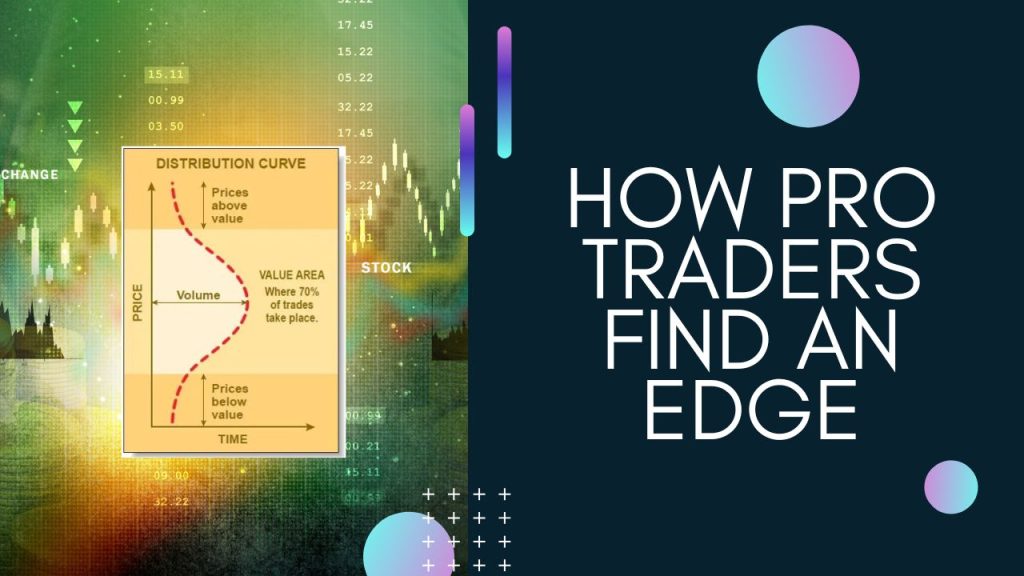

How Pro Traders Find an Edge

Learn how seasoned traders read order flow, momentum and risk to uncover information beyond charts alone. This disciplined approach explains how to define value, time entries and manage risk with precision.