Two Interesting Trades

A breakdown of two stocks that showed up on MTM’s trade scanners today: Opendoor Technologies (OPEN) and MicroStrategy (MSTR).

PLTR Tip-Off

Palantir is up ~100% over 4 months but testing key levels. Options flow showed a trader betting on PLTR holding $160–165 into next week with a call condor.

Wheelin’ and Dealin’ in AAPL

We’ve been putting the wheel strategy to work in Apple (AAPL). So far, every short put we sold has been bought back at a lower price — keeping the difference.

Scale Tipper for INTC

The U.S. is reportedly exploring a 10% stake in Intel. No governance rights, but still the largest shareholder. That kind of backing—especially with government contracts in play—could reshape how Intel trades against Nvidia.

Don’t Sell

Today’s market? Total snoozer. One of the lowest volume days in six months and barely any movement in the S&P 500. But under the surface, volatility is showing some important clues.

1 of 2 Ways

PPI came in hot—way above expectations—but SPY barely moved & traded on light volume. Could be a buyer’s trap.

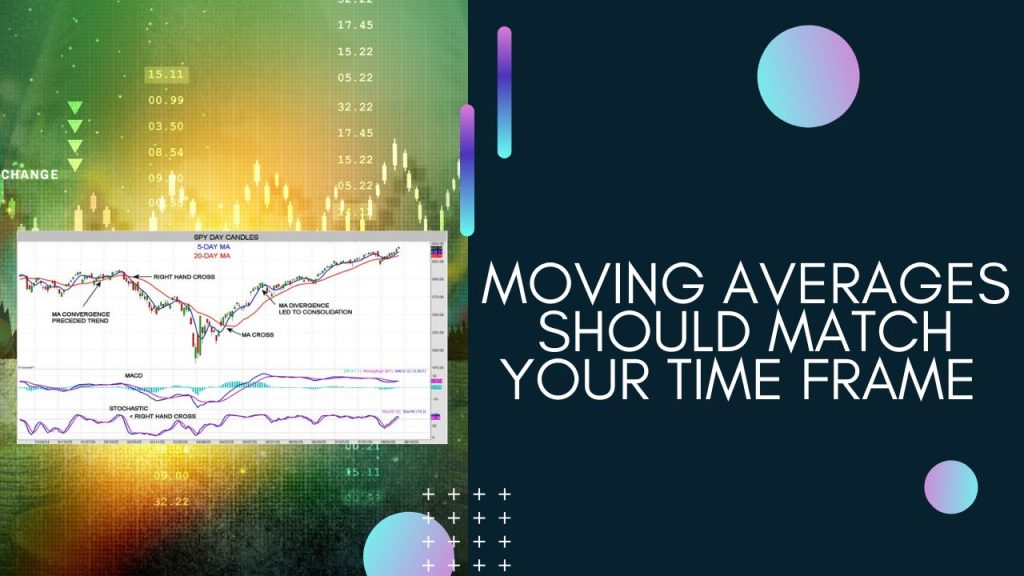

Moving Averages Should Match Your Time Frame

Not all moving averages are created equal—and the right one depends on how long you plan to hold your trades.

CPI Bump

CPI landed almost exactly where expected today, and that’s a plus for consumers and for those looking for signs of a possible rate cut.

Uncertainty

The word of the day: uncertainty. The S&P 500 slipped just 0.2% today, with SPY closing at 635.92 — basically flat. Why?

Where to Invest If…

Markets opened strong but pulled back late in the day. SPY closed at 632.25 — down just under 1%, so basically flat. What caused the shift?

Are You Stressed as a Trader?

Risk reversal trades can be useful when you’ve got a strong directional feel on the market and want to potentially take advantage of intraday movement using same-day expiration options (0-DTE).

Do Dividends Matter?

If you’re building a long-term portfolio, the answer is yes — dividends can play a major role in compounding over time.

Big Happenings Monday

Big Monday comeback! After last week’s rough close, the S&P 500 rallied 1.5%—and there are some key reasons why.

Done Deals

The S&P 500 swung nearly 3% today on one of the heaviest volume sessions in a year—and sellers won the battle.

How to Improve Entry and Exit Levels

Want to improve your trade entries and exits? Recognize strong support and resistance by looking left on your chart.

Making History

The Fed held interest rates steady today—as widely expected. But what wasn’t expected? Two governors dissented. That hasn’t happened since 1993.

Trading LEAPS

LEAPS: Long-dated options with long-term potential.

How to Repair a Broken Stock

Bought a stock and now it’s way down? With the stock repair strategy, you can potentially make up that loss if the stock just recovers halfway.

Putting Risk Reversal Trades to Work

Risk reversal trades can be useful when you’ve got a strong directional feel on the market and want to potentially take advantage of intraday movement using same-day expiration options (0-DTE).

Shooting Stars

Ever seen a candle push up then fade out? That’s a shooting star—a one-candle chart pattern that can signal a possible reversal.

Volatility Mesas

What is a volatility mesa—and why does it matters more than you might think?