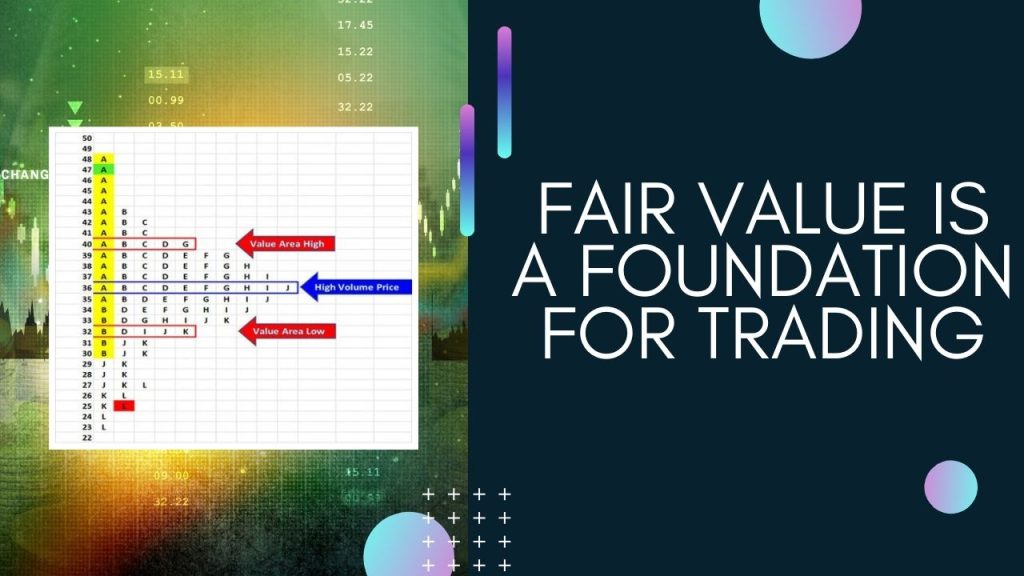

Fair Value Is a Foundation for Trading

Spend time with a broker or pit trader from the era when all trades were executed by brokers in trading pits at exchanges and you will learn about open outcry and the information it provides. Pits were created to facilitate trade. To an untrained eye a trading pit is a ring filled with angry, aggressive people wearing badges on various colored jackets. But for a seasoned observer a trading pit reveals incredible amounts of information not available on screens or trading platforms. Professional traders monitor order flow. They use a combination of market-generated information (technicals) and fundamentals (supply/demand or earnings) to define and refine strategies.

Market Confirmation

Volatile Week Coming

High Volatility Alert!

Reminder: Tighten Your Option Management

Have you noticed how volatile the market is and how it seems to gap almost every session at the open? Of course you have—unless you have been stuck under a rock. This post is a reminder that option management needs to be front and center at all times, and many times risk need to be taken off the table early.

Big News!

Tips for OOO Trading

Why Is Gold Up?

The Monty Hall Dilemma and Opening Your Mind

The Monty Hall Dilemma is a classic thought experiment that trips up even the smartest people. The same kind of faulty intuition leads traders to make bad decisions every day.

Prepare for This

The ‘C’ Word

Trade Tomorrow’s News

A Sweet Bear Put in TSLA

In this post, we’re walking through a bear put trade in TSLA from late February, highlighting how spotting technical setups and choosing the right expiration can create an edge.

3 Opportunities I See

The ‘T’ Word

NVDA Earnings Sell-Off

Lessons From the Futures Pits

Spend time with a broker or pit trader from the era when all trades were executed by brokers in trading pits at exchanges and you will learn about open outcry and the information it provides. Pits were created to facilitate trade. To an untrained eye a trading pit is a ring filled with angry, aggressive people wearing badges on various colored jackets. But for a seasoned observer a trading pit reveals incredible amounts of information not available on screens or trading platforms. Professional traders monitor order flow. They use a combination of market-generated information (technicals) and fundamentals (supply/demand or earnings) to define and refine strategies.

Lack of Confidence

Interesting Week Ahead

Volatility of Volatility

Psychology Is Key in Options Trading

You heard it here first: Psychology is key in options trading. Actually, you probably didn’t hear it hear first, but I bet when you did you didn’t believe it right away. To be honest, neither did I. When I started out as a retail trader, I had no idea how important psychology is to successful option trading. And even though I quickly learned this lesson, it took me several years to get a handle on it.