Over the past 30 years, 20 of which were on the trading floors of the CBOT and CME, I have been a broker, analyst and educator for many types of traders. Whether they were speculators, hedgers or fund managers they were asking similar questions. Where is fair value or where has most of the volume traded? Are bulls or bears in control of momentum? What is a good price to buy or sell? Is the timing right for a trend? What is the risk once in a trade? What is the profit potential? How do I protect my profit? Markets are in constant flux, so it is imperative to have methods to answer and react quickly to the questions traders ask. In these first few articles I will focus on such inquiries.

In order to address the most common questions I created an acronym called V.E.R.T.E.X. I refer to it when creating strategies or writing daily commodity market updates. The V stands for Value, E is for Energy or Momentum, R means Risk, T is for Timing, E is for Entry and X is for eXit.

In this article, I will focus on ‘V’, defining the Value area and high volume price. The high volume price is simply that price which buyers and sellers agree upon most often. Time at this price allows volume to accumulate. Therefore, we can use time as a proxy to measure volume (Price + Time = Value). Many data providers and platforms show actual volume at price but for our purposes time will suffice.

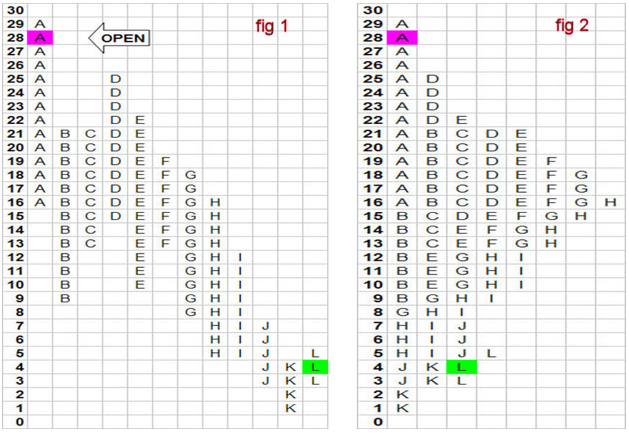

Market Profile has been my technical tool of choice since the mid 80’s. It displays the required dimensions to implement a logical approach to trading. Most charts have price bars that are parallel to each other. This tool tracks time at price using 30 minute periods. Each period is assigned a letter and when stacked on top of each other a bell curve or profile forms (see fig. 1 and 2).

This structure allows the user to determine fair value. The high volume price, also known as the ‘point of control’ is shown in fig 3. It is that price that has traded in more 30 minute periods than any other. From that point of control, we can construct a fair value area which is one standard deviation of volume around that mean. It covers roughly 70% of the volume around that high volume price. Generally, any price that has 4-5 letters in the day profile holds value. Why is value important?

High volume prices and value areas help us determine momentum. Momentum is defined as the movement away from a fair price. In addition, value areas are useful when defining risk. The top of the value area defines risk when prices are declining and the bottom of value defines risk when prices are rising.

In the next issue we will focus on reading momentum.

John Seguin

Senior Futures Instructor

Market Taker Mentoring Inc.