I have a bunch of different sayings when it some to options trading, but this one might be my absolute favorite: “Know exactly what you will do no matter what happens.” What this really means is that I want traders to have a trade management plan in place before they enter a position. As we have talked about so many times before in this blog, having a trading plan is imperative to your potential success as a trader because it is mandatory to remove the emotional part of trading. This is why knowing what you will do, and actually doing it, can improve your success and profits.

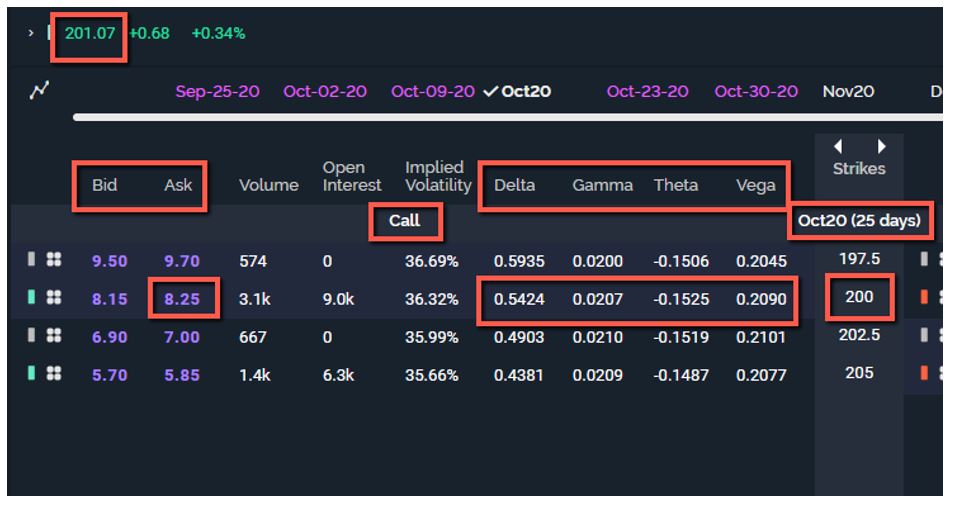

Here is a quick example using the chart and option chain below.

Let’s say a trader was bullish and expected the stock to rise after breaking some resistance just over the $200 level. He (or she) decides to buy an October call as his choice to profit from an expected move higher. He buys the call and pays 8.25 (see below).

Based on the chart, the stock has potential support at around the $197 area, or about $4 below where the stock is currently trading. His management plan if the stock moves lower (against the position) would be to consider closing out some or all of the position if the stock closes below that potential support level. In addition, he could also choose to manage some of the position by risking 25% of the cost. In this case if he rounded up, it would come out to close to $2.10 (8.25 X 0.25) a call option. If the position declines to about $6.15 (8.25 – 2.10), close out some or all of the position.

On the profit side, there is potential resistance from previous pivot levels around $205. He can say if the stock moves up to the $204 area, consider taking some potential profits at that level. In addition, since 25% may be risked on the stop loss, 25% (or $2.10) can be considered as a potential profit too. In this case, if the call’s value increased to about $10.35 (8.25 + 2.10), consider taking a profit. A GTC (good until cancelled) sell limit of 10.35 should be considered.

This was just a quick example of how having a plan in place can potentially improve your trading outcome and remove unwanted emotions. Just make sure you know how you will handle every conceived situation before it happens, and I promise you will be better off and less anxious about your trades.

John Kmiecik

Senior Options Instructor

Market Taker Mentoring, Inc.