I love to find opportunities where I can buy calendar spreads for a neutral bias. In fact, we have feasted on them in MTM’s Group Coaching class for a long, long time now. The most important part about a calendar, whether it be neutral or directional, is that the underlying is trading as close to the short expiration as possible. There is no debating that point, but an option trader can get an edge from a proper implied volatility (IV) skew. What if there is no IV skew? A short iron condor may be a good choice in that case. Let’s take a look.

IV Skew Edge

An IV skew edge for a long calendar is when the IV level for the short option (shorter expiration) is larger than the long option (longer expiration). The bottom line is to sell more expensive premium than you are buying. There is less risk overall, and the max profit and breakevens grow. But without an IV skew, a short iron condor could be a valid choice. A short iron condor can work better when IV levels are elevated, but if there is no IV skew or a reverse IV skew (larger on the long option) it may be your second and best choice.

SPY Example

Recently in Group Coaching, we had been looking for a neutral opportunity in the S&P 500 ETF (SPY). But as we looked at the IV levels, we found there really was no advantage based on an IV skew. IV levels were a bit elevated because there were several expected volatility events taking place that week. In the hourly chart below of the SPY, you can see the ETF was trading between some potential support around $395 and resistance around $404.

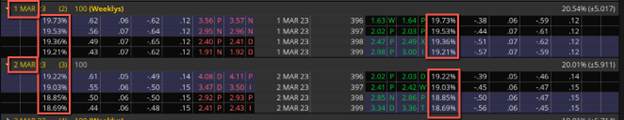

But as you can see below, there was not much of an IV skew between Wednesday’s expiration and Thursday’s expiration.

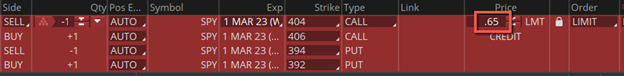

Instead, we considered a short iron condor by selling the 392/394 put spread and the 404/406 call spread for Wednesday’s expiration as seen below.

Both trades would have benefitted from neutral action from the ETF. But without an IV skew a long calendar seems a bit less attractive, especially since IV skews have been abundant over the past several months.

Finally

As noted above, it is not mandatory to have an IV skew to trade a long calendar, but I would rather wait until there is one to consider a long calendar. A short iron condor will be there for you as a good backup if there isn’t.

John Kmiecik

Senior Options Instructor Market Taker Mentoring, Inc.