Could Be a Trap

Volatility remains unusually low despite rising concerns in AI stocks, suggesting heavy option selling may be masking underlying market risk.

High Times Ahead

The market stayed quiet near key technical levels, but attention shifted to potential marijuana reclassification, a policy change that could reshape the business outlook for THC-related companies.

Employment Numbers Tomorrow

A quiet market day sets the stage for a major employment data release, with non-farm payrolls, unemployment rate, and earnings reports due tomorrow that could drive market direction.

Data Barrage

The market sits near all-time highs as a wave of key data—jobs, CPI and PCE—arrives next week. These releases may shape expectations for future interest rate moves.

When to Use a Put Back Spread

Discover how the put back spread strategy targets large downside moves with defined risk and high profit potential. A step-by-step COIN example shows how traders structure and analyze this bearish options play.

Fed Prep

A major Fed announcement is coming, and with the market pricing in a likely rate cut, Powell’s tone afterward may determine whether stocks push higher or break lower.

When to Trade Straddles

A straddle is a volatility-based options strategy that works only when a stock makes a meaningful move, making timing, cost, and risk management essential.

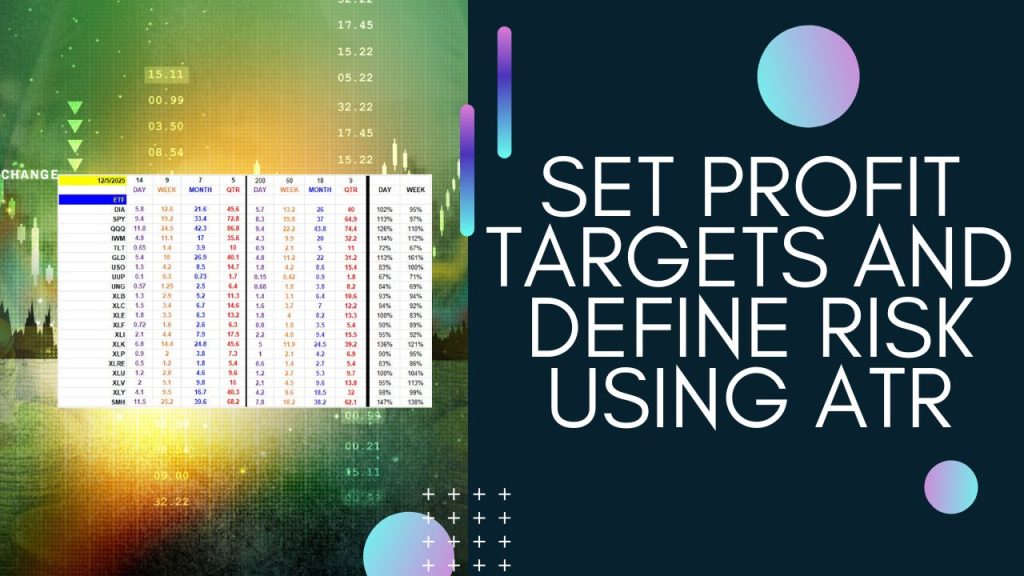

Set Profit Targets and Define Risk Using ATR

Analyze recent and long-term ATRs each year to assess volatility, identify trend or consolidation potential, and set informed risk and profit targets for upcoming trades.

Pro Traders Bearish?

Credit Spread Genius showed mostly call credit spreads today, hinting that pros aren’t expecting much upside.

New Chip Deal?

SPY was flat and VIX dipped, but we still don’t have a higher high on the chart. The standout news is Apple reportedly looking at Intel’s 18A chip process, adding fuel to the push for more onshore chip production.

Beware: Short Squeeze!

Silver is getting squeezed as futures traders cover shorts and inventories stay concentrated in just a few vaults and ETFs. Even London is short on supply which has pushed spot above futures.

Bull Call or Call Calendar?

I’m a big fan of both bull calls and call calendars, but how do you know which one to use with a move higher?

The Big Winner in AI Will Be…

SPY held over its 50-day and VIX cooled off but the real move was Meta planning to buy AI chips from Google. That hit Nvidia while Google kept climbing.

Optimism

Dan breaks down why the market jumped to start the week, pointing to comments from Fed Governor Waller that sparked optimism around a possible 25-basis-point rate cut.

Why Stocks Reversed

Nvidia ripped higher after earnings, then reversed and fell below its 50-day, heading toward key support near 180.

Trading Tool Rules You Can Use

Generally, the tools of trading are designed to reveal trend strength, change in trend and timing entry, and can help with setting risk and projecting profit targets.

Big Day Coming

Nvidia reports tomorrow, and with 7.5% of the S&P 500 + IV pointing to a ~6% move, Thursday could bring real volatility.

Careful About This

This is a strange week for data. Thursday’s non-farm payrolls release will reflect September numbers because the shutdown prevented collection for October.

The Death Cross

Not all chart patterns are created equal — but one to always keep an eye on is the Death Cross.

When to Use Call Back Spreads

Let’s take a quick look at when and why you might consider a call back spread.

Eat Mor Chikin

Pilgrim’s Pride (PPC) isn’t an AI stock or a chipmaker — it’s a chicken processor. But sometimes the quiet stocks are where the value hides.