It’s Time to Update Your Plan

Key Support Level: How Low Will It Go?

Unfortunately, This Solution Won’t Work This Time

Is This, “Sell The Rumor, Buy The News?”

Will This Support Hold?

Huge Upside Surprise! Here’s Why…

Massive Call Buying in AMC Today

Delta Can Make or Break Credit Spreads

One of the biggest topics I discuss in MTM’s daily Group Coaching class is how delta can make or break a credit spread. Option traders associate credit spreads as mostly a positive theta trade. I am going to show you why I believe delta is the bigger factor usually. When you think about selling a […]

Today’s End of Day Sell Off: What It Means

The Squeeze in ATER

Here’s Why It’s Better to Trade In Down Markets

This Is Why I Like Earnings Time Spreads

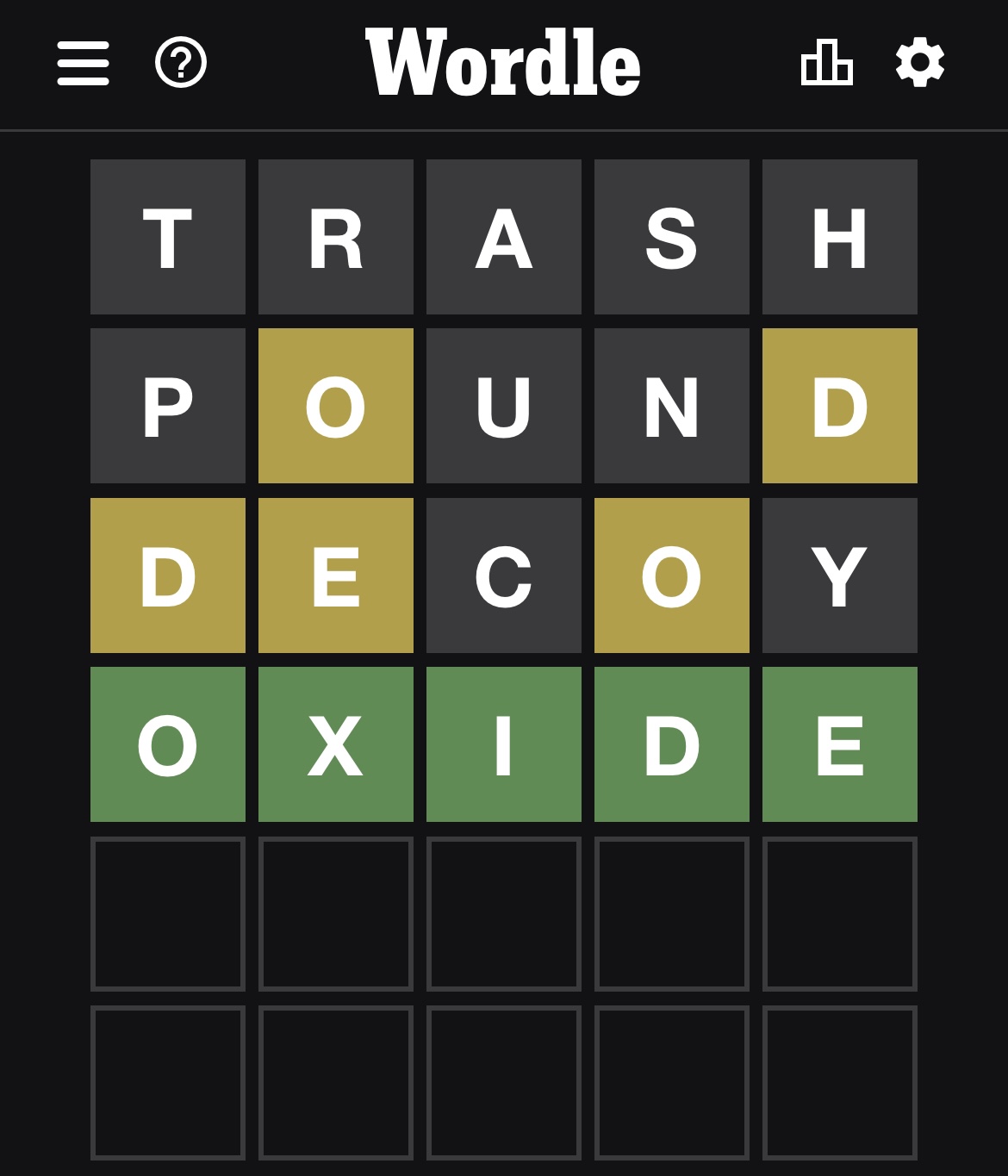

It’s Like Wordle, Only Better

Routine is important. Admittedly, I don’t always have the strictest regimen by any means (I’m working on it, OK?). But one thing I do religiously is my daily Wordle. If you’re not familiar with this little cultural phenomenon, Wordle is the latest wordy brain game that seemingly everyone and their brother plays. (Which is why […]

Earnings Season Is Here (It’s a Big Deal)

Volatility Mesas, What They Are and Why They Are Important

Short-Term Calendars on the SPY

Time spreads, and in particular calendar spreads, are one of my absolute favorite option strategies. Long calendars give an option trader a lot of options. They can be used as a neutral or directional strategy, and they mainly profit from time passing – hence the name time spreads. Having three expirations a week on the […]

Volatility Spikes, What They Are and How to Trade Them

Volatility Percentile, Where to Find It and What It Means

A Warning About Selling Naked Puts

With another wave of earnings right around the corner, I feel the need to caution option traders and investors about selling “naked” or cash-secured puts over an earnings announcement. Whether you refer to it as writing or selling naked options, many option traders do not understand the risk. Selling a put option without having a […]