Historical and Implied Volatility

With the market supposedly heading towards the slower summer months, it is always important but probably even more so for option traders to understand one of the most important steps when learning to trade options; analyzing implied volatility and historical volatility. This is the way option traders can gain edge in their trades especially when […]

Fractal Position Management

Option traders have to manage risk. Want a job description? That’s about it. In fact that is a job description for every trader; even ones that don’t trade options. Every trade has a risk and reward associated with it and traders must realize that especially when first learning how to trade. Because options are instruments […]

Implied Volatility and Bull Put Spreads

Implied volatility (IV) has been relatively low in the market until recently. With recent downturn in the market, some implied volatility levels have increased of of their recent lows. Implied volatility by definition is the estimated future volatility of a stock’s price. More often than not, IV increases during a bearish market (or a sell […]

What Is an Option Strangle?

An option strangle is an option strategy that option traders can use when they think there is an imminent move in the underlying but the direction is uncertain. With an option strangle, the trader is betting on both sides of a trade by purchasing a put and a call generally just out-of-the-money (OTM), but with […]

When Investors Should Consider a Collar Strategy

A collar strategy is an option strategy that can particularly benefit investors. In this blog we have a lot more options education for traders and less for long-term investors so here is a strategy both can consider. A collar is simply holding shares of stock and buying a put and selling a call. Usually both […]

Weekly Options and Time Decay

There are so many different characteristics of options that I talk a lot about with my options coaching students. But one of the more popular subjects is that premium sellers see the most dramatic erosion of the time value of options they have sold during the last week of the options cycle. Most premium sellers […]

Thoughts on Front-Month Puts

With the market threatening to move lower after a bullish run last year and earning’s season upon us,it might be a good time to talk about put options. If a trader buys a put option, he or she has the right to sell the underlying at a particular price (strike price) before a certain time […]

The Best Online Trader Community in the World!

Thank you all for your overwhelming support for our brand new MTM Elite Trader’s Community. I’m glad to say the launch of this state-of-the-art traders’ resource was a HUGE success! We promised you the best trader chat room ever to exist! And we delivered! The new MTM Elite Traders Community has been referred to as […]

Six-Year Low in the VIX? What’s It Mean to YOUR Options Trading?

The VIX, or CBOE’s Implied Volatility Index, hit a six-year low this week. What’s that mean to options trading? Lots! Options trading is greatly affected by implied volatility. At its most basic level, when the VIX is low, it tends to mean lousy options trading. Option traders are not incented to trade when the VIX […]

Double Calendars vs. Double Diagonals

Today we will talk about a subject that is brought up quite often in MTM Group Coaching and is often debated by option traders learning to trade advanced strategies; double calendars vs. double diagonals. Double Calendars vs. Double Diagonals Both double calendars and double diagonals have the same fundamental structure; each is short option contracts […]

Trade Management

Learn how to manage trades by watching this video.

Analyzing Stocks

Learn how to Analyze Stocks b y watching this trading video.

Option Volume and Open Interest

Learn all about Option Volume and Open Interest by watching this video.

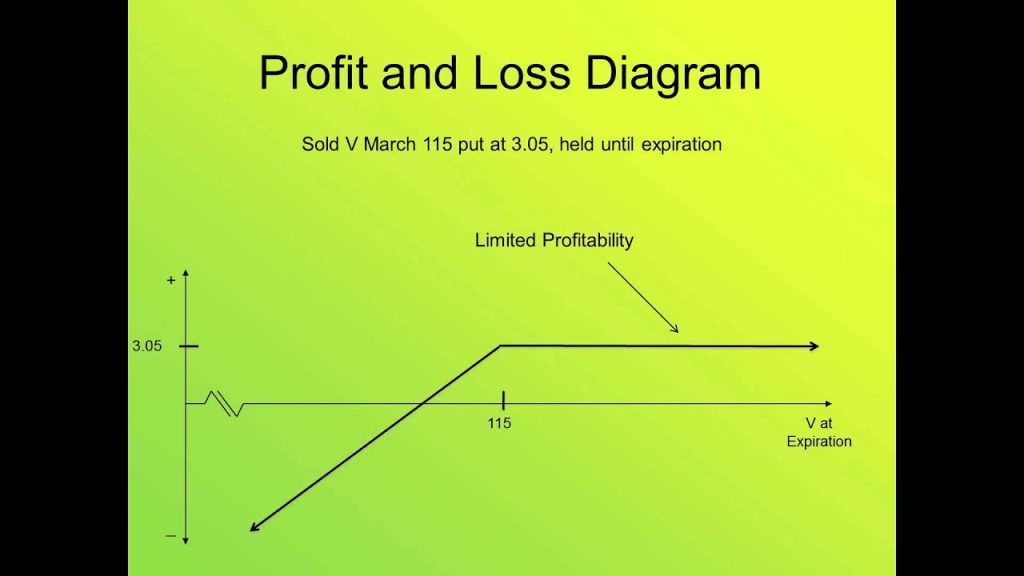

Trading Short Puts

Learn how to trade short puts in this trading video.

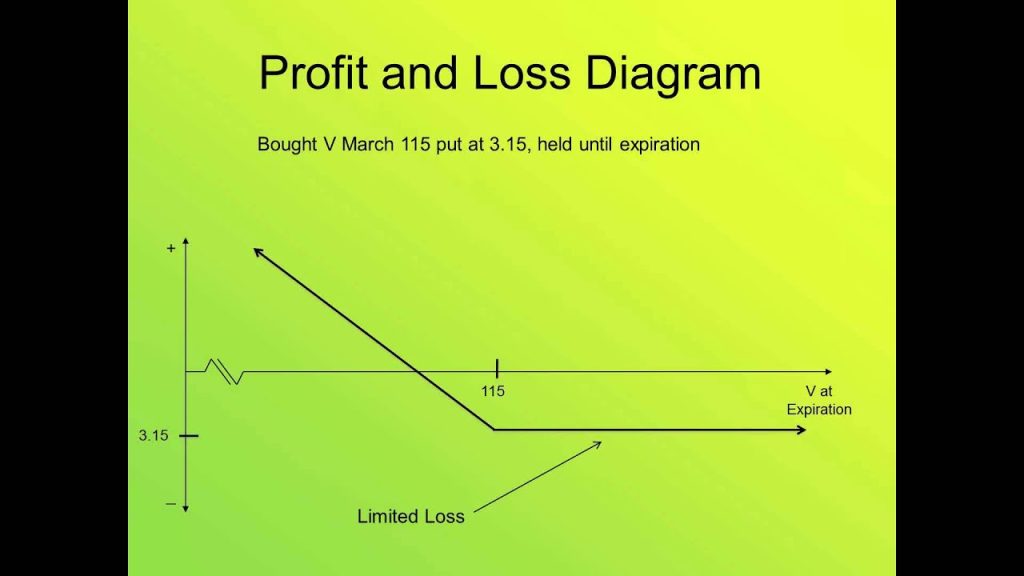

Trading Long Puts

Learn about trading long puts in this trading video.

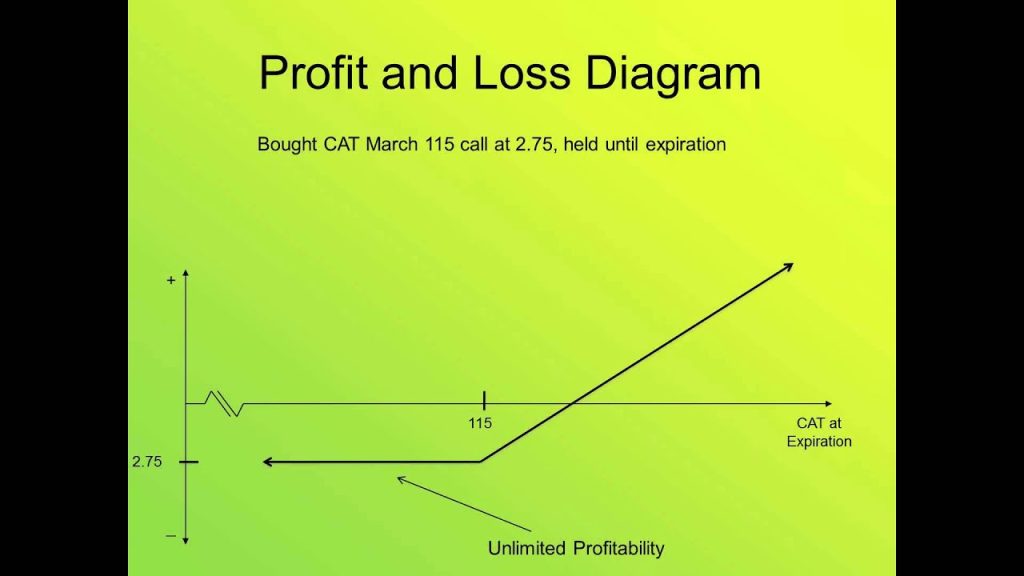

Trading Long Calls

Learn all about trading long calls by watching this video.

Bull Call Spread vs. Purchasing a Call on AAPL

Bull Call Spread vs. Purchasing a Call Let’s say that you have a moderately bullish bias toward a stock and the overall market is slightly bullish. Is there a way that you can take advantage of this investing scenario while limiting risk? Certainly, there are a few. One that is often superior to the rest […]

Trading Google Earnings

Google’s earnings announcement has caused high volatility in the stock. What should traders expect this time? Watch this video as Dan Passarelli of MartketTaker.com explains what to expect when Google announces earnings.

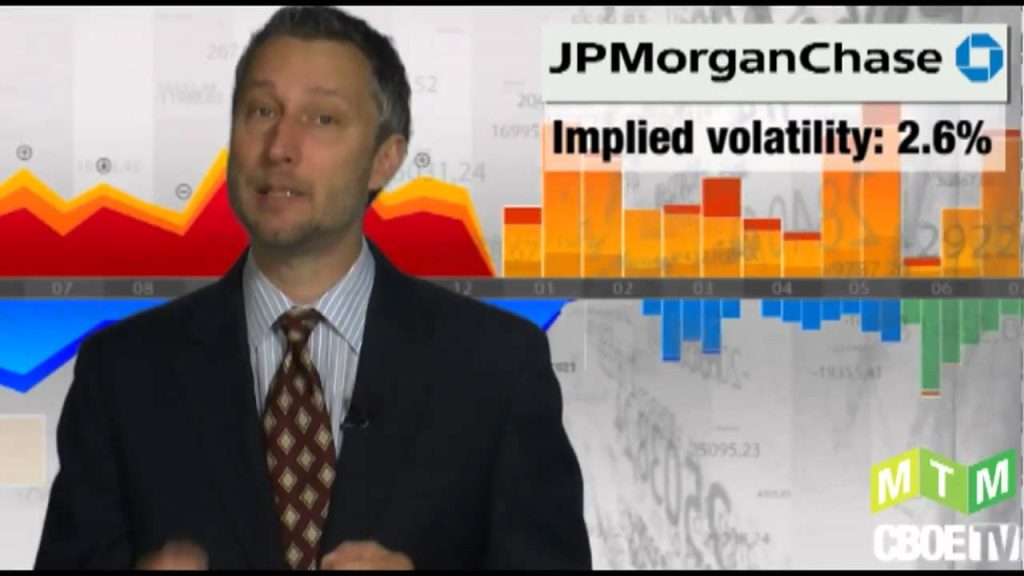

How to Trade JPM Into Earnings

Dan Passarelli of Market Taker Mentoring explains how he uses implied volatility to craft his strategy in JPM before earnings.

Possible Bullish Option Play

Is there a possible bullish option play in Home Depot? Dan Passarelli of MarketTaker.com discusses a potential option play on this pullback in the stock today.

Buying Opportunity in Ford Motor Co.mp4

Ford stock is trading below $10 a share. Is it time to buy? Watch this video from Dan Passarelli from MarketTaker.com.