When to Use a Put Back Spread

Discover how the put back spread strategy targets large downside moves with defined risk and high profit potential. A step-by-step COIN example shows how traders structure and analyze this bearish options play.

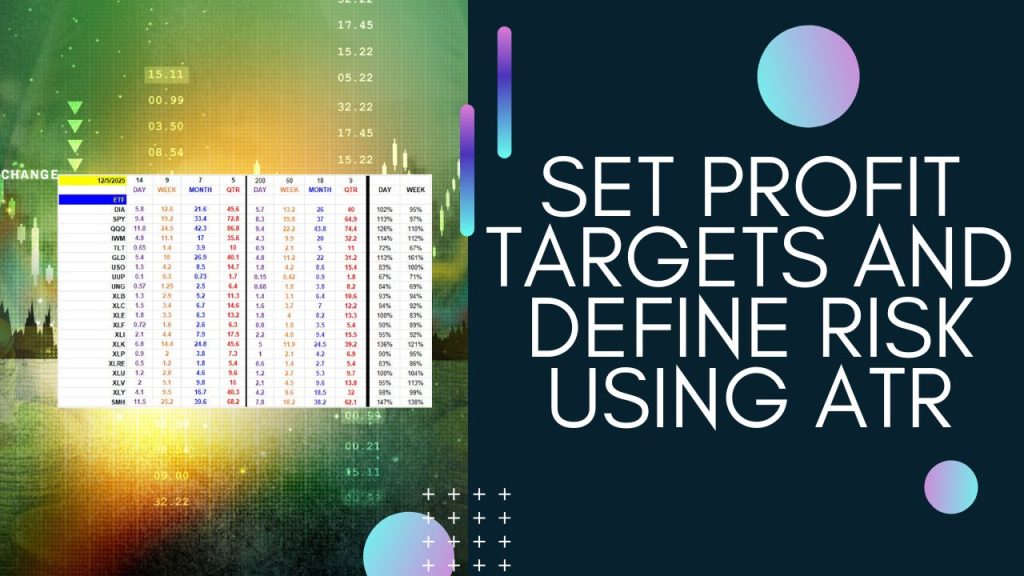

Set Profit Targets and Define Risk Using ATR

Analyze recent and long-term ATRs each year to assess volatility, identify trend or consolidation potential, and set informed risk and profit targets for upcoming trades.

Bull Call or Call Calendar?

I’m a big fan of both bull calls and call calendars, but how do you know which one to use with a move higher?

Trading Tool Rules You Can Use

Generally, the tools of trading are designed to reveal trend strength, change in trend and timing entry, and can help with setting risk and projecting profit targets.

When to Use Call Back Spreads

Let’s take a quick look at when and why you might consider a call back spread.

Identifying Support and Resistance Areas

To determine support and resistance areas, we use charts that reveal the history of price action.

Bull Call Spread in GLD

Gold prices seem to keep setting record highs each week, and we’ve been jumping on the bandwagon in MTM’s Group Coaching class, where we regularly look at GLD (Gold ETF).

How to Identify Candle Clues

Candlesticks are one of the best momentum indicators. They track the distance between the open and close over any time frame.

Remember to Have a Plan

Here is a quick reminder to plan out your trade management strategy before entering any trade.

Your Trading Task Checklist

The road to becoming a well-rounded broker/trader/educator pressed me to develop a list of tasks that I use faithfully before recommending or entering a trade. Here is my checklist.

Trading Resistance in PLTR and ITA

The market, as of late, has continued to try to move higher and we’ve seen no significant pullback. As I like to tell traders: Don’t fight the trend. Go with the flow and look for opportunities to put on bullish positions, like a break through a resistance level.

How to Use Pivots and Moving Averages

Moving averages are the most popular directional gauges. They are typically the first technical indicator in the novice trader’s toolbox. Many professional traders rely on them as well. Typically, the directional signals come when a short-term MA crosses a longer-term MA.

Manage Profit and Risk Using Trailing Stops

Stop loss orders are used to set risk. They can also be used to manage profitable trades with an order type known as a “trailing stop.”

4 Definitions of Option Delta

Knowing what option delta is and what it means for your option position is a key component of a profitable trade. Let’s look at the four main definitions of option delta.

The Flexibility of Average True Range

Average True Range (ATR) is a flexible gauge that can be used to set support/resistance areas, profit targets and risk.

Wheelin’ and Dealin’ in AAPL

We’ve been putting the wheel strategy to work in Apple (AAPL). So far, every short put we sold has been bought back at a lower price — keeping the difference.

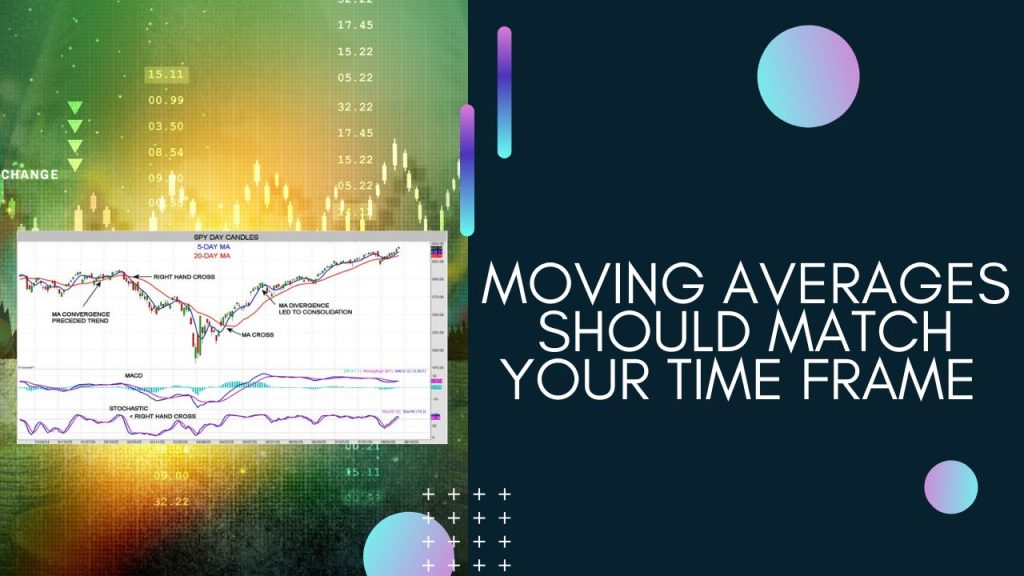

Moving Averages Should Match Your Time Frame

Not all moving averages are created equal—and the right one depends on how long you plan to hold your trades.

Are You Stressed as a Trader?

Risk reversal trades can be useful when you’ve got a strong directional feel on the market and want to potentially take advantage of intraday movement using same-day expiration options (0-DTE).

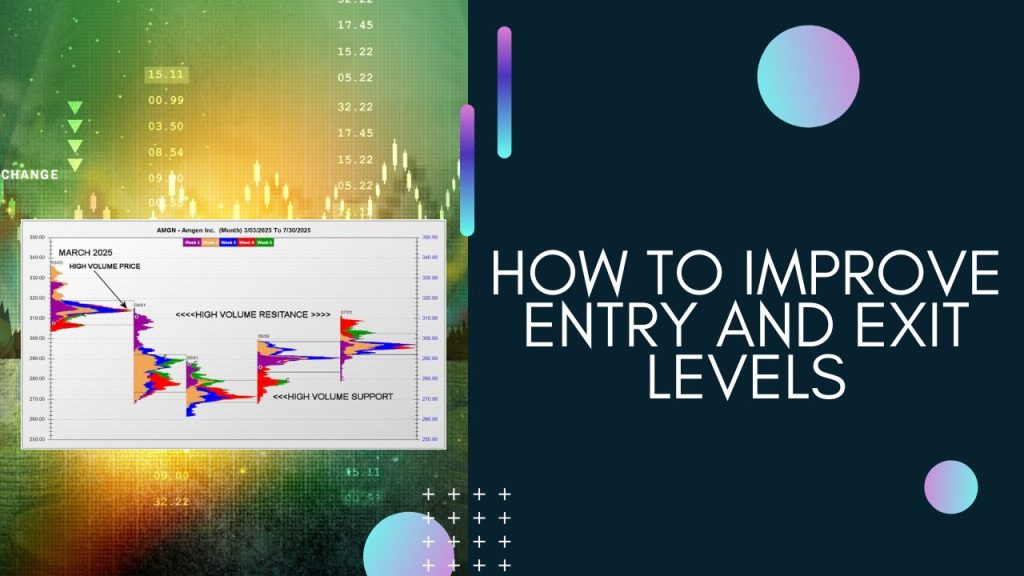

How to Improve Entry and Exit Levels

Want to improve your trade entries and exits? Recognize strong support and resistance by looking left on your chart.

Putting Risk Reversal Trades to Work

Risk reversal trades can be useful when you’ve got a strong directional feel on the market and want to potentially take advantage of intraday movement using same-day expiration options (0-DTE).

Practice Like a Pro

Want to trade like a pro? Start by practicing like one. Great traders practice consistently and build instincts they can trust.