Option vega, like option gamma, is one of those option greeks that often confuse option traders. But it does not have to be that way. Below we will break down the dynamics of vega so that even the most basic of option traders will have a clearer picture of this mystery greek.

What Is Option Vega and How Does It Work

Option vega measures the impact implied volatility (IV) has on option premiums. Keeping it simple, for every 1% change in IV, vega will change the premium by that amount. If IV rises 1%, option premium will rise by the amount of vega, and if IV falls 1%, option premium will drop by the vega amount. For example, if IV is 35%, vega is 0.05 and the option premium is 2.50, a 1% increase from 35% to 36% will increase the premium by 0.05, or to 2.55. Option traders love when IV increases for long option positions and decreases for short option positions. Because of this, long options, both calls and puts, have positive vega. Short options, both calls and puts, have negative vega.

Just like option gamma and option theta, vega is highest at-the-money (ATM) and smaller in-the-money (ITM) and out-of-the-money (OTM). But unlike gamma and theta, vega gets bigger further out to expiration. So a longer expiration means a larger vega number.

Buy low and sell high applies to IV as well. As an option trader, you want to buy premium when IV is considered low or cheap. Once in the position, you prefer IV to rise to increase your premium. As a premium seller, you prefer IV to be high or expensive when premium is sold. Then you prefer IV to decline after the position is initiated. If an option trader believes IV will rise after initializing the position, a positive vega position is preferred. If he or she believes IV will fall after initializing the position, a negative vega position is optimal. But what if the position has positive vega and an IV decrease is forecast or vice versa? Let’s take a look.

Neutralizing Option Vega

There is a saying in Chicago where I am from that if you don’t like the weather, wait 30 minutes and it will change. The same can be said about the option greeks including vega. The way to decrease and sometimes totally neutralize vega is by using a spread and in particular a vertical spread.

Let’s keep this lesson fairly simple. Option prices are affected by IV, as we know. If IV is higher than normal, option prices tend to be high. If IV is in the lower part of its range, option prices tend to fall. Let’s pretend the market just had a big sell-off with prices dropping and IV rising. After the drop, an option trader now believes stocks will reverse and move higher again with IV levels and option prices moving lower again.

A long call position with positive option delta can profit from a move higher. But the position also has positive vega (long positions have positive vega) and IV is expected to come down. What is an option trader to do?

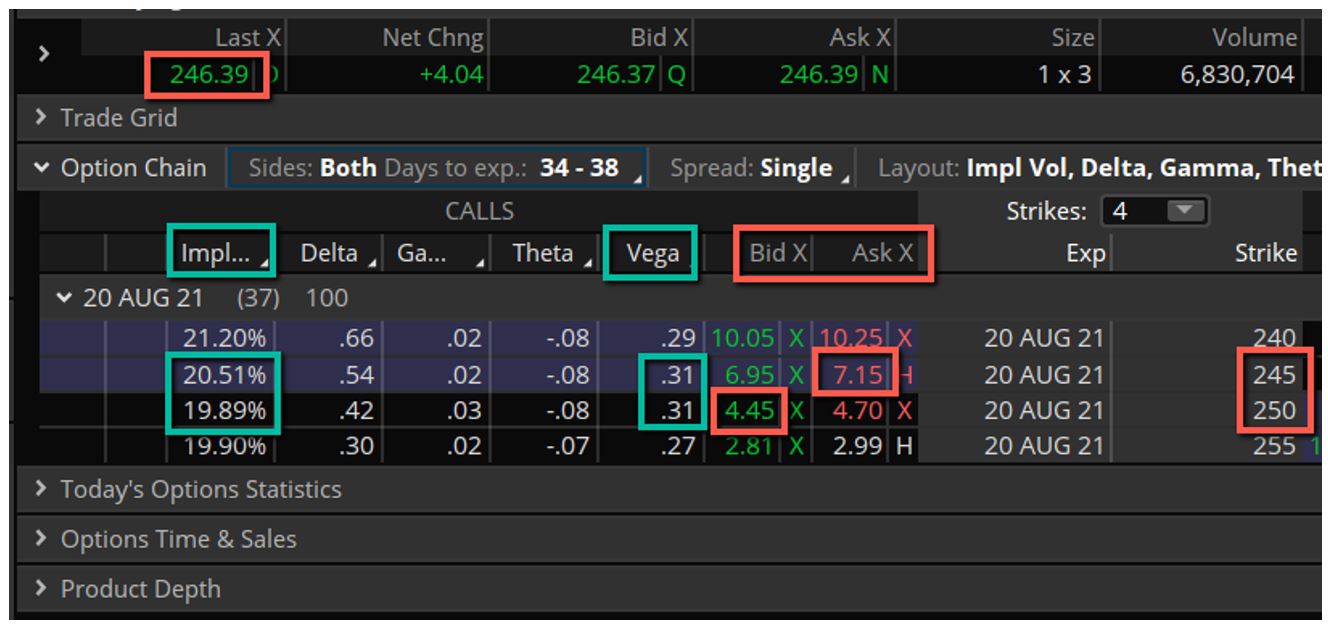

Take a look at the option chain below.

The 245 strike call could be purchased for 7.15 and have a positive vega of 0.31. IV is currently at 20.51%. What if the stock rallied as was forecast but the IV dropped 5% down to 15.51%? Based on the current vega of 0.31, 1.55 (0.31 X 5) would be subtracted from the call premium. But what if a spread (in this case a bull call) was initiated?

In the example above, the 245 call is bought and the 250 call is sold. Take a look at the vega on the position. Before selling the 250 call, the position had a positive vega of 0.31. After selling the 250 call, the vega position is essentially neutral (0.31 – 0.31). So if IV drops, the position will not be as affected as it was before when the position had positive vega and would have lost premium. Of course, the max profit is now limited and the positive delta is also smaller as well, but universal IV fluctuations will not make a major impact on the position.

Final Thoughts

This is just one way to offset vega risk, but it can be rather effective, particularly in down markets when a move higher is expected. The same is true when IV is low and a rise in IV and fall in the market is expected. Negative vega positions can be offset with a long positive vega position. As I like to say, when in doubt, spread it out.

John Kmiecik

Senior Options Instructor

Market Taker Mentoring, Inc.