I always like to say there are two things an option trader can do that can 100% improve his or her trading. Of course, there are more than that, but the two I am referring to are not subjective at all. In this post, I’ll address the first one, and at a later date we’ll look at the second one.

Tight Vertical Credits

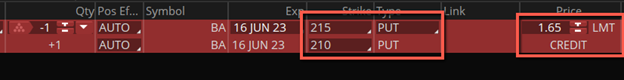

One of the biggest mistakes I see retail and professional option traders make is selling a credit spread with a wide strike difference. The wider you make the spread from the short to the long strike, the worse you make the percentage credit and risk. Do the tightest spread between the strikes and just do more contracts. Take a look at the example below.

The option trader is selling the 215 put and buying the 210 put for a total credit of 1.65 ($165 in real terms). But there are other options (no pun intended) that have 2.50 increments. So instead, the 215 put is sold but the 212.5 strike put is bought for a credit of 1.00 ($100 in real terms). Just imagine if he or she would have bought 2 212.5/215 spreads instead of 1 210/215 spread. The total credit would have been 2.00 ($200) instead of 1.65 ($165) like below.

It’s a No-Brainer

To me, this is an absolute no brainer. Why give the market maker anything extra and deny yourself potential profits and at the same time lowering your risk? The moral of the story is to sell vertical credit spreads with the tightest spread possible from the short to the long strike. You will thank yourself for it, I promise.

3 Responses

Great point John!

Very good point. I will use this technique in the future. Thanks John.

Where have I heard this before. Oh yeah from you John!