How to Manage Theta on 3-day Weekends

Market Ups and Downs

Getting to the Next Level

This Number Tells All

Buying Straddles for Value

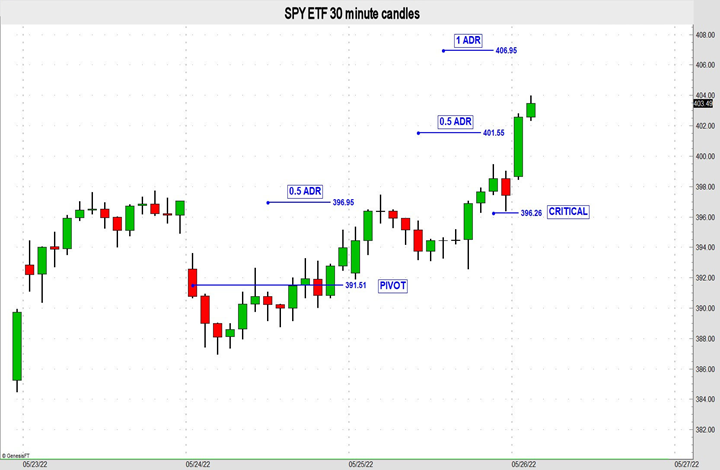

How to Use Critical or Pivotal Prices

Critical or pivotal prices are used in various ways. Some traders use them to identify support and resistance areas, entry and exit zones. They may also be used to define momentum. There are more than a few ways to determine daily pivot points. The most popular requires some basic math using the high, low and […]

Key Crossover in the S&P500 Today

Revenge of the Meme Stocks

In a Sea of Red, This Stock Is Trading Higher

This Is A Key Moving Average

I Almost Had a Heart Attack

Back To Risk Off

What Do You Know About Option Theta?

What do you know about option theta? For many, it can be the easiest option greek to understand, but for many others it is the most difficult. Let’s take a quick look below and, let’s hope, clear up some confusion. Theta Definition Theta measures the rate of decline in the value of an option due […]

Identifying A Trading Channel And How To Trade It

Psychological Trading Levels

I Can (Almost) Predict this Will Happen

This May Be The Best Learning Experience In A Decade

Are You Only Thinking About Bullish Option Trades?

Let’s play trading psychologist and patient. If you have not figured it out by now, trading is psychological warfare for a human. Psychology is a huge part of trading. Without overcoming your emotional fears and being disciplined, you have little chance of being successful at trading options. So, when the market is moving lower, as […]

This Is Why I Rely On Signals

Correction: Not a Correction

Rho: It’s Back!

I haven’t had to think about this one for a while. But after 14 years, it’s back in play: the option Greek rho. The Option Greek Rho Let’s just dig right in, shall we? Rho is the option Greek that measures an option position’s sensitivity to a change in interest rates. It works like some […]