The First Week of Earnings Season Is About to Start

Lessons Learned for 2023

Yes. I know. But it’s not a typo. As of this year, I’ve been in options for 29 years. And do you know what my objective is for 2022? It’s to get better at trading. You’d think I’d be over that, seeing as it’s been my objective every year for, well, 29 years. But I’m […]

Preparing for Earnings Season [Tip of the Day]

Volatile Day in the Market – Where Do We Go Next?

The Good News and the Bad News

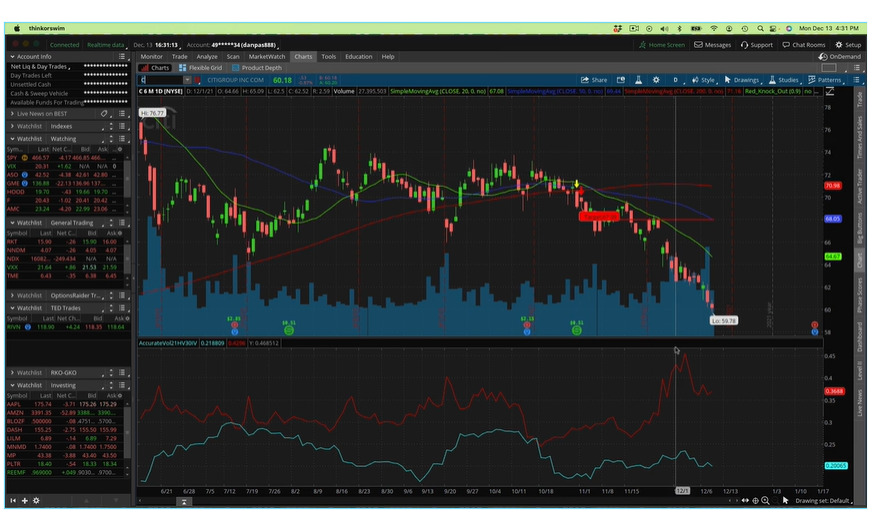

A Call Credit Spread on AMZN

The market has been very volatile over the past several weeks and Amazon Inc. (AMZN) has been no exception. In the first part of December, we looked at a chart of the stock in MTM’s group coaching class and determined it was a good opportunity for a call credit spread (bear call spread). Call credit […]

Robinhood (HOOD) Stock and an Interesting RSI

The January Effect and Your Trading

Journaling Your Trades

Separate Your Trading and Investing

Here comes Santa Claus

Option Position Sizing Made Simple

You know what can really kill a trading week? When you win on 8 small trades and lose on 1 big trade. “Why did I trade that one so big? That was STOOPID! Ugh!” That’s what we end up saying in our heads to ourselves. Right? Well, position sizing is one of those things that […]

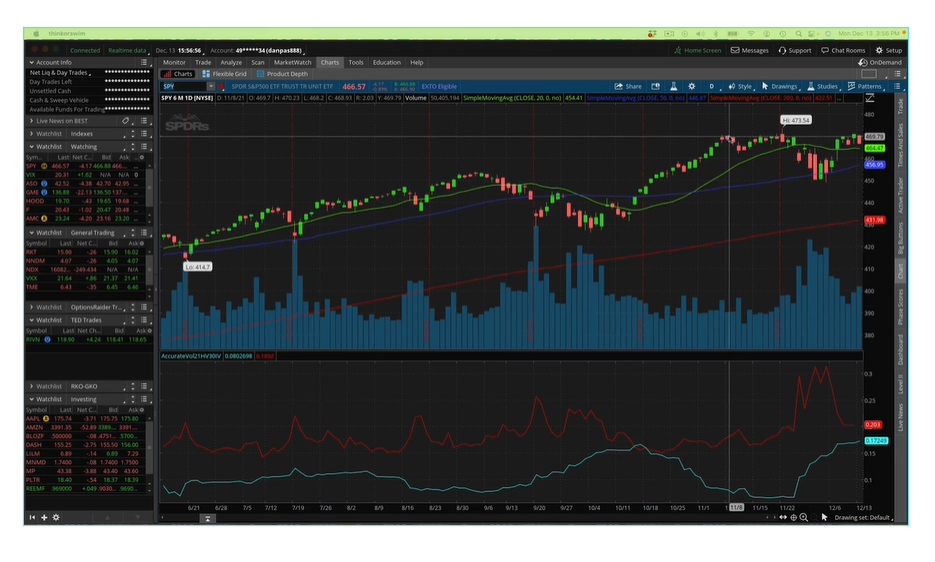

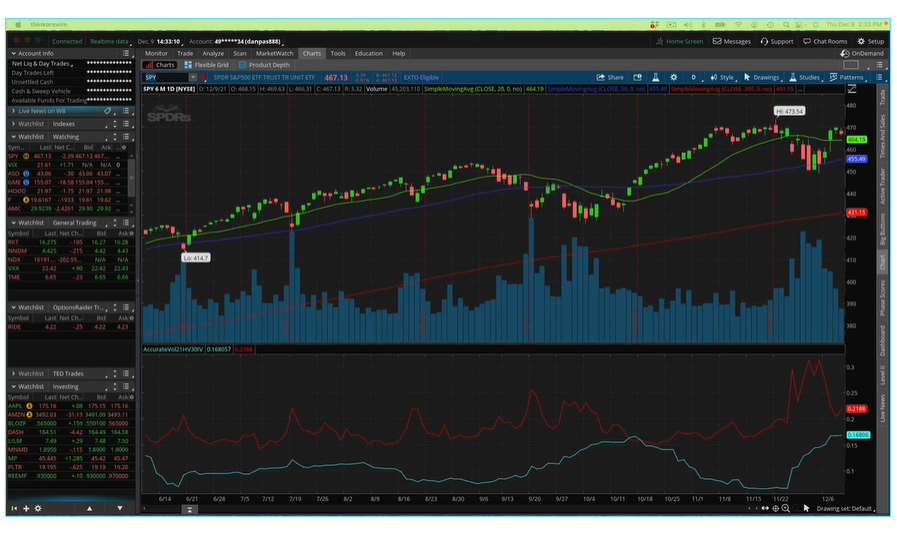

Manchin, Omicron and The FED: Where is the market going next?

Are meme stocks back?

The Vega Trap

Volatile Markets Call for Patience as an Option Trader

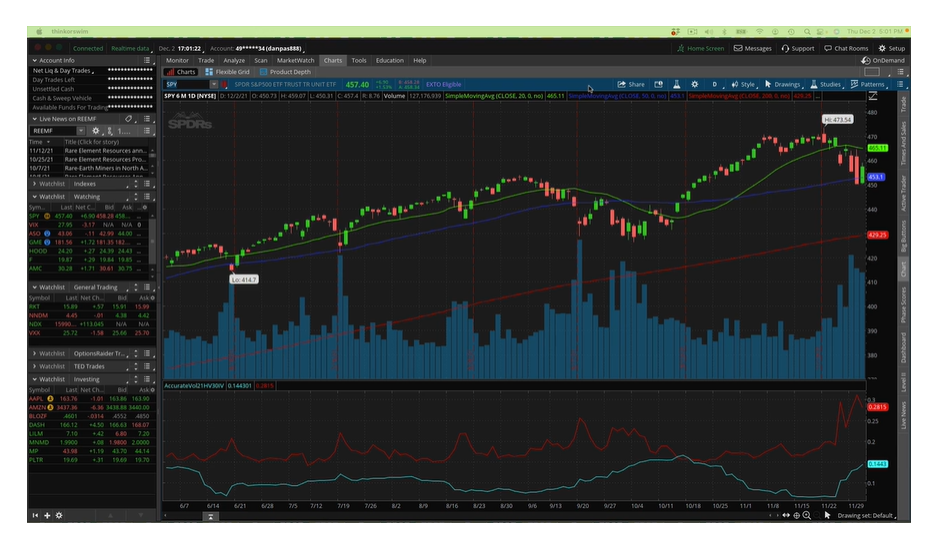

If you have not noticed, the markets have been very volatile over the past couple of weeks. If you add in September’s decline, it has been a bumpy road for several months. Even though the markets have been uncertain, there is something you should be clear about and that is the importance of being patient […]

Pivotal week for S&P500

Your weekend research

Playing the China Stock Market Rebound

China is an interesting place. From the outside (and in reality) the communist country has made huge strides in the direction of capitalism over the past 10 years or so. The move, like all aspects of business (and culture and, well, everything), has been orchestrated by none other than the Chinese Communist Party (CCP). China […]

Low VIX, High Volatility Move?

Has There Been a Permanent Shift In the Crypto Market?