Option Management Is Key

Consider this a friendly reminder about managing your option trades. With the craziness and the volatility of the market over the past few months, I have gotten multiple questions during MTM’s group coaching class and especially through email about managing trades. For the most part, the trades in question are losing ones. I always tell […]

Option Trades for a Non-Bullish Outlook

Several weeks ago, I looked at option trades for a non-bearish outlook. In this blog, we will look at some non-bullish options so to speak. To recap from my previous post, I often break down the market or individual equities into five separate categories: bullish, bearish, neutral, non-bullish and non-bearish. The first three are most […]

To the Moon and Other Meme Stock Trader Fallacies

You’ve probably, by now, perused the famed subreddit WallStreetBets and maybe some of the others that talk about short squeezes in stock trading. If you haven’t, you should. Or maybe you shouldn’t. Not if you’re faint at heart anyway. (You’ll read some profane things you can’t unread. LOL.) Short Squeezes in Stocks One of the […]

Do Not Fear the Short Iron Condor

If you haven’t noticed, the market has been a volatile mess or, as I like to say, there’s been a lot of slop and chop. With implied volatility levels and option prices still relatively high, it is a potentially good time to sell some neutral premium. One of the best strategies to do that is […]

Fighting for a Piece of Cloth

Kathleen, the kids and I recently returned from a really wonderful trip to Italy that we’ve been planning for years. We had a lot of great food. Saw a lot of cool stuff. But the coolest thing I did while I was there was attending what is known as “Il Palio.” If you’ve never heard […]

Option Trades for a Non-Bearish Outlook

I often break down the market or individual equities into five separate categories: bullish, bearish, neutral, non-bullish and non-bearish. The first three are most likely understandable, but non-bullish and non-bearish might need a little explanation. To me, non-bullish is when you are fully bearish on the market or individual equity but believe resistance levels will […]

Life in the Fast Lane

It’s perhaps one of the greatest guitar riffs in the history of rock and roll. You know the one. The little ditty that intros and is intermittently revisited throughout the Eagles’ hit “Life in the Fast Lane.” (And, yes. I realize you’ll now have this earworm running through your head for the next three hours. […]

Market Timing Is Important for Options Trading

Market timing is often defined as moving money in and out of the market or switching into other asset classes. But is can also mean timing your entry correctly. That is what I want to talk about here. But let’s be honest, as option swing traders (generally in the trade for 2 to 5 days), […]

Why Not to Work on Vacation

I’m taking some time off on what I’ll call “a well-deserved vacation.” But I wanted to share this blog with you, well, while I’m on vacation. When I was a kid, my family never really went anywhere. There was one time my grandfather took all the grandkids to Disney World. Other than that, we pretty […]

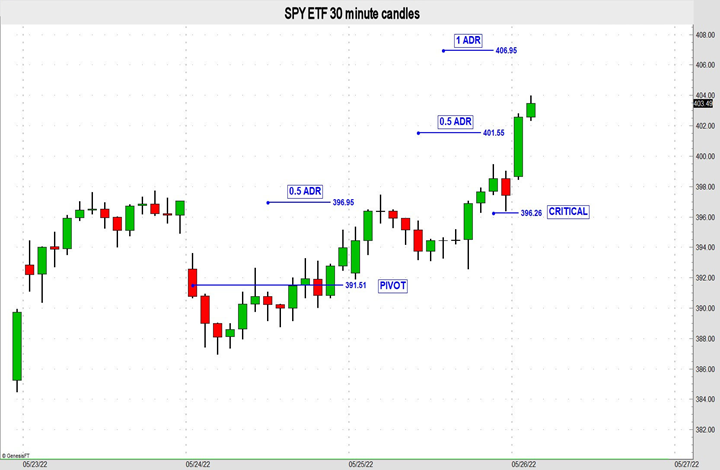

Practical Uses for Average True Range

Practical Uses for Average True Range Average True Range (ATR) is one of the most practical indicators and can be used in many ways. Some of the ways I employ ATR is to compare recent ranges with longer-term or benchmark averages. In this way I can judge whether current volatility is high or low. Spreads […]

How to Use Critical or Pivotal Prices

Critical or pivotal prices are used in various ways. Some traders use them to identify support and resistance areas, entry and exit zones. They may also be used to define momentum. There are more than a few ways to determine daily pivot points. The most popular requires some basic math using the high, low and […]

Are You Only Thinking About Bullish Option Trades?

Let’s play trading psychologist and patient. If you have not figured it out by now, trading is psychological warfare for a human. Psychology is a huge part of trading. Without overcoming your emotional fears and being disciplined, you have little chance of being successful at trading options. So, when the market is moving lower, as […]

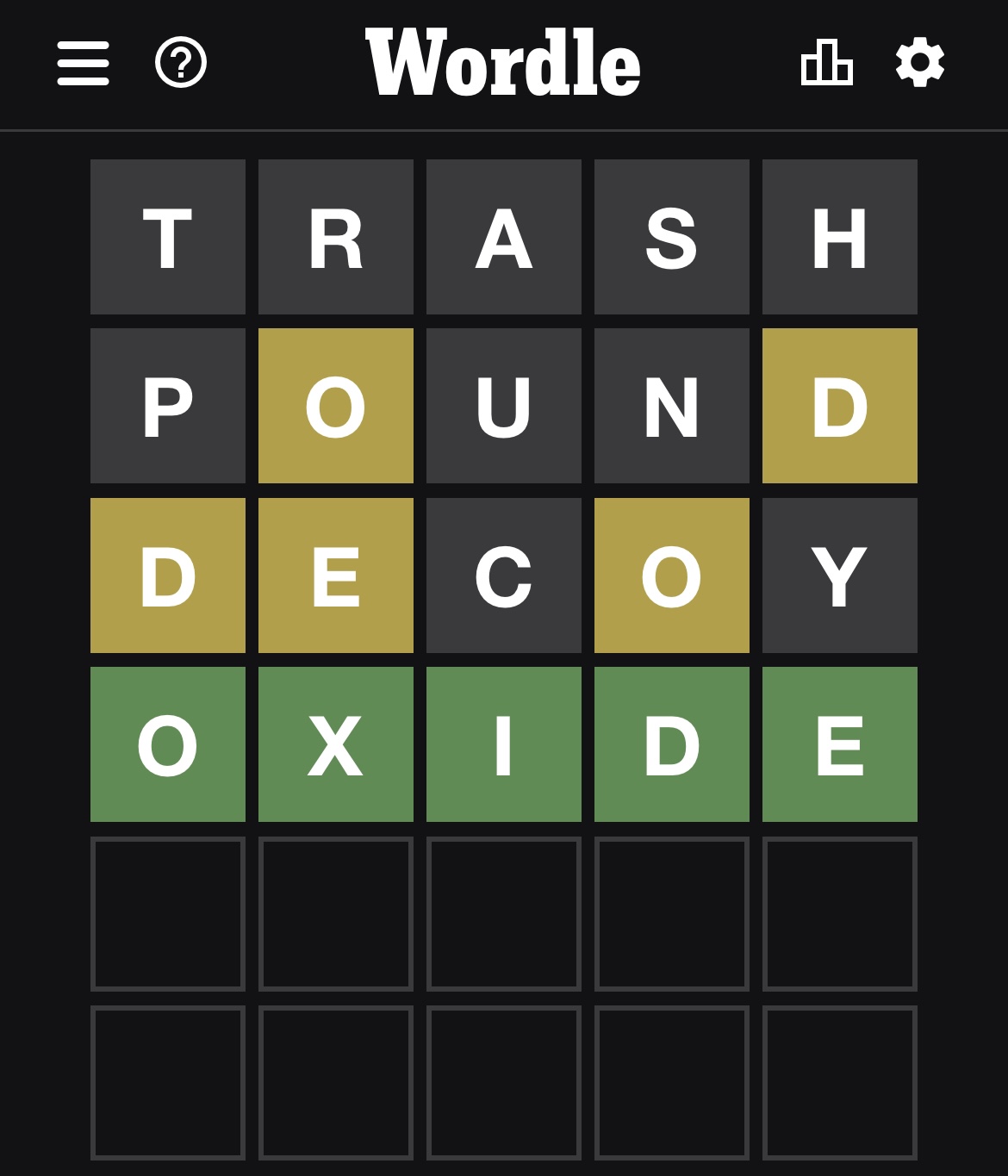

It’s Like Wordle, Only Better

Routine is important. Admittedly, I don’t always have the strictest regimen by any means (I’m working on it, OK?). But one thing I do religiously is my daily Wordle. If you’re not familiar with this little cultural phenomenon, Wordle is the latest wordy brain game that seemingly everyone and their brother plays. (Which is why […]

Access Leads to Excess

How is it possible for some professional traders to make the excess profits they do? Are they smarter than you? No. (And I’m not just being nice. My experience shows it’s true.) If anything, they just have a little more experience. Do they take more risk? Definitely not. In fact, they take less. Are they […]

Get to Know Your Options Trading Platforms

“I’m a carpenter but I don’t know how to use any of my tools.” … Said no one, ever. If you work in any field, knowing how to use the tools of your trade is, legit, one of the most important things you can put your efforts toward. It goes the same for trading. Options […]

Trade Management Needs to Be a Priority

Whether you are new to options or have been trading them for several months or decades, you know there is plenty to learn and discover about them. Essentially with stock, there are only two things you need to know: buy and sell. With options there are more moving parts, like implied volatility (IV) and the […]

Have You Ever Thought About Modeling?

I was working with one of our student traders recently, and we spent a lot of time talking about modeling… trades, of course. Duh. Modeling option trades is an underused part of any proven trading methodology. I’d go as far as saying that trade modeling should literally be done on every single trade. It’s important […]