When creating short-term trade strategies, the first task is to understand what upcoming fundamental events are likely to have the biggest impact. In the financial markets at this point, employment and inflation data have the most impact on stocks, ETFs, bonds, foreign exchange, precious metals and even energies.

On the first Friday each month the Labor Department releases the employment report. A week after that we typically get inflation (CPI) and retail sales numbers. And near the end of the month, we see the Personal Consumption Expenditures Price Index, which is the Federal Reserve’s benchmark inflation gauge for setting monetary policy.

Event risk is high and a jump in volatility is common when these reports come due. Try to avoid new directional plays in financial assets the day before such events. Be prepared to enter trades shortly after the data are released.

Identify Who Controls Momentum

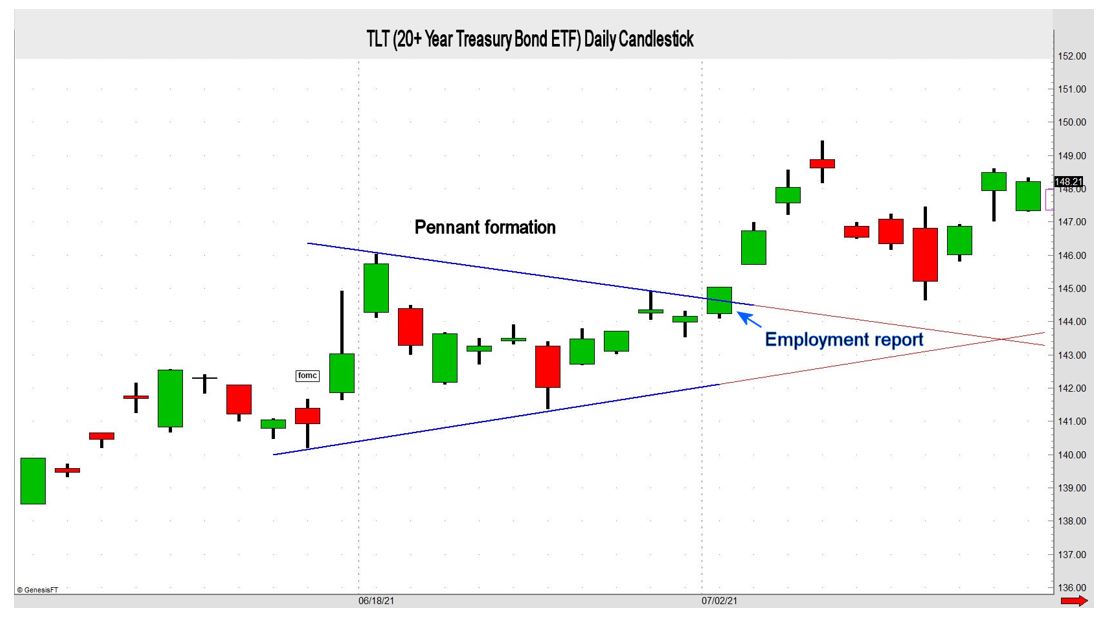

Before event risk rises, make it a priority to define a fair value area, if possible. A fair area or congestion zone usually takes the shape of a flag (rectangle) or pennant (triangle). Bull or bear momentum is defined when these structures are violated. In the chart below the upper trendline was breached following a monthly employment report. A few sessions of positive price action ensued.

Setting Risk

Once a position is taken the next logical step is to set risk. Risk differs for each trader. Account size and time horizon are arguably the most influential risk factors. Using the example above, a long position should continue to pay if the market does not get below the upper trend line within the next two days.

Another method for defining risk is a static stop loss. For example, once a trendline is breached a stop is immediately placed at 50% of an average day range (ADR) below entry. If a short position is taken the stop loss would be 50% above of an ADR. My preferred average day range is a 14-day sample.

Set Profit Targets and Mitigate Risk

After setting risk, the next practical step is to plot multiple profit targets. The logic behind this method is to mitigate risk quickly and lock in more profit as the market moves in your favor. For short-term trades I refer to ATRs or Average True Ranges.

When a trendline is violated, my first target is 50% of an ADR. When that goal is realized move stop loss to entry. This technique is known as a trailing stop. If a trend does not materialize, this approach reduces risk to theoretically zero.

Target 2 is 100% of an ADR from entry. When that goal is attained, move stop to the first target or T1.

Target 3 is 75% of an average week range (AWR). When T3 is achieved, move stop to T2 to appreciate more profit.

Target 4 equals 100% of an AWR from entry. For a short-term trade reaching an AWR is the goal. When that goal is attained, take profit or move stop to T3 and let it ride.

Consistency Is Key

Building a consistent approach to trade entry and management is a habit of great traders. Following a playbook allows the trader to make seemingly instinctual decisions while reducing subjectivity or guess work.

John Seguin

Senior Technical Analyst

Market Taker Mentoring, Inc.