Using Double Distributions to Identify Trends

To be a good market analyst and trader, you should make it a point to learn intricate details that are illustrated in charts. The study of charts or technical analysis is what most trading systems are built upon. Learning and problem solving are a big part of artificial intelligence (AI). The idea is to get […]

3 Things You Need to Know Before You Trade a Straddle

It’s shocking. Most people simply don’t make money trading straddles—even when things are volatile. Why, you ask? It comes down to just 3 simple factors that are often overlooked by traders. And once you know them, you’ll be a better trader in all situations—especially when expecting high volatility. How Straddles Work Straddles are simple—on the […]

A Look at Market Reversals and Relationships

These are tough times for all, and it will get worse before it gets better. For traders these highly volatile markets can be scary because the normal fundamental data do not influence markets like we are used to. Fundamentals trump technicals, but even now the fundamentals cannot be trusted. The day ranges for the equity […]

Level-Headed Fundamentals: A ‘Coronavirus Market’ Mile-High View

This is a Coronavirus market. We've got two things going on here: The human aspect and the economic aspect. Both are emotionally charged. And the good news is that it’s going to be OK. Seriously. It really is. It might not always feel like it at any given moment. And I’m not trying to take […]

Now Is a Good Time to Review Your Trades

Option traders generally love volatility. It gives them an edge that stock traders cannot get. But when market volatility is running rampant as it has been over the past several weeks, it can make things a little more difficult for option traders. Generally, option traders are not day traders. They typically hold positions overnight. With […]

Top 3 Trading Strategies for the Coronavirus Market

[Click the image above to watch Dan's video; here is the transcript.] I’ve had lots of questions on how to trade the markets during the Coronavirus outbreak. Should we sit it out? Should we be all in? Should we short everything? It can be nerve-racking to know what to do, so I’m going to share […]

Coronavirus Creates Commodity Chaos

For a few decades the first thing I have done each morning after turning on the coffeemaker is to check the movement in futures markets. I follow the financial and energy sectors closely. My checklist includes stock indexes, interest rates, precious metals, crude oil and currencies. If these sectors have unusually large ranges, I immediately […]

Crazy Market? Consider an Iron Condor

This market is enough to make some option traders crazy and broke. Who would have thought new highs would be consistently made almost on a week-to-week basis? For the most part, the major indexes have moved higher over the past several months, but there have been times when the market inexplicably has done a reversal […]

The 60-Minute Rule of Trading

Stock indexes continue to break barriers in response to positive economic data. The historic rise has also come with headwinds such as impeachment, coronavirus and conflict with Iran. The question on many traders’ minds is, what will prompt the next big downturn? The markets are sensitive to the spreading of the virus. As the number […]

Reducing Risk as an Option Trader

There is no sure thing as an option trader when it comes to profits, no matter how much the odds may be on your side. All trading is speculative, but as traders we do our best to improve the odds. But what if there isn’t a setup that matches our criteria for entry? The simple […]

Coronavirus: How to Protect Your Trades

Stock indexes took a big hit this week following news that the coronavirus was spreading around the globe and that the death toll was rising. The initial reaction incited a decline over the next two days that spanned about 75% of an average month range. When a market moves that far in such a short […]

A Prepared Trader Is a Profitable One

This week was historic for more than a few reasons. The United States-Mexico-Canada Agreement was accepted by all three countries and should be passed in early January. Phase 1 of a trade agreement with China was signed. The pact included some resolution to theft of intellectual property. There will be large purchases in agricultural products […]

Traders Deserve a Break

This is my usual blog that I write every soften where I implore you to take some time off from trading. The market will be there when you get back. No matter what you do or did for a living, everyone needs some time off to energize themselves. Trading is no different. I recently told […]

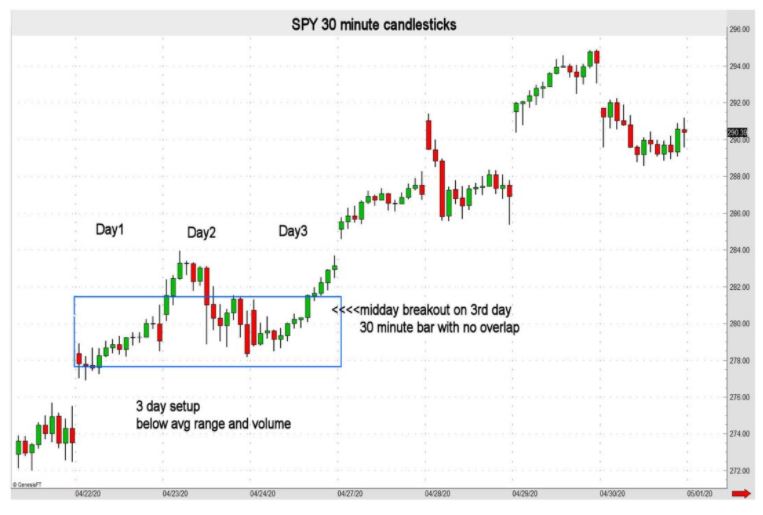

How to Enhance Trade Entry

I learned long ago that keeping a trade journal not only helped me recognize patterns that suited my personality, but it also taught me how to avoid repeating mistakes. The journal, through diligence and repetition, permitted me to develop a short-term entry strategy to enhance the timing for catching longer-term trends. One of my biggest […]

My Favorite Option Things

Every year Oprah releases a list of her favorite things ahead of the holidays. According to her magazine, she has selected 79 perfect presents and one bonus selection for 2019. I also have a list, but it is not seasonal. It is a few phrases I like to use that I think can make you […]

Fed’s Stance Sparks Fundamental Shift

Over the past week we saw a subtle fundamental shift, but sometimes that is all it takes to get a trend rolling. It started with the Fed hinting at a more neutral stance. A fourth interest rate cut had been widely expected in the December FOMC meeting. That may not happen now as some members […]

Is Option Trading Easy?

Let’s answer that question right now before we go any further…no! It takes a lot of work and patience to be a profitable option trader. Getting started by putting some cash into a trading account is easy. But that is where the easy part ends. Not only do you have to learn about calls and […]

How Will Brexit Affect Markets?

I was writing my daily commodity market updates early Thursday morning and just as I was ready to hit send, stock indexes and interest rates rose abruptly. The euro and pound rallied while the dollar dipped. Gold fell as well. These immediate reactions were reversed later in the day when it appeared not everyone in […]

To Find Money Flows, ‘Follow the Sun’

A week ago, we finished the first of 2 MTM Mastermind sessions. On the last day we had a visit from a very good friend and colleague, CNBC’s Rick Santelli. He and I worked together in the ’90s where we compared notes often. We each had our own personal style and technical approach to analyzing […]

How to Trade ‘in the Zone’

It was the mid-1980s and I was in my mid-twenties when I stepped on the CBOT trading floor as an employee. I was terrified, intimidated and eager. I got a jacket with team colors, a badge for access to the pits, and a warning to keep my mouth shut and do what I was told. […]

Learning the Option Greeks

As summer comes to a close here in Chicago, I have spent more than the usual amount of time over the past few weeks reviewing the option greeks in our Group Coaching class. It is always important to know about the greeks when trading options, but many traders neglect to properly educate themselves. It has […]