Playing the Odds with Support and Resistance

Support and resistance levels matter — a lot. If the underlying’s stuck in a range, neutral setups like long calendars can be a great fit.

The Energy Un-Crisis

The U.S.’s broad spectrum energy sector is having a moment…and it’s a good one.

What to Do When a Stock Trades Sideways

What do you do when a stock just trades sideways? Covered calls can be a great move.

Trading Low Volume Pockets and Gaps

When markets break out of consolidation, they often do so with force—leaving behind low-volume pockets, or “volume voids.”

Take Advantage of Holiday IV Skews

When the market’s closed mid-week, IV levels can dip for the shorter week. That opens up a play for time spreads.

Trade Location and Timing

Spotting a breakout before it happens? That’s where edge comes from.

Why I Love Calendar Spreads

Let’s talk about calendar spreads, a solid time-based option play that can work whether the market moves a little… or barely at all.

Timing Reduces Risk, Increases Profit Potential

One of the easiest ways to reduce risk and boost trade potential? Better timing. It’s not just about what you trade—it’s when you trade it.

Are You Trading or Gambling?

Don’t force your views on the market. Step back, adjust with a level head, and follow the data. That’s how you stay a trader—not a gambler.

Best Tips for Bollinger Bands

Bollinger Bands are incredibly versatile: they can signal overbought/oversold conditions, help with trend identification, and guide neutral or breakout strategies depending on band width.

To Adjust or Not to Adjust

The market continues to take option traders on a volatile ride, but adjusting your position is not always the answer.

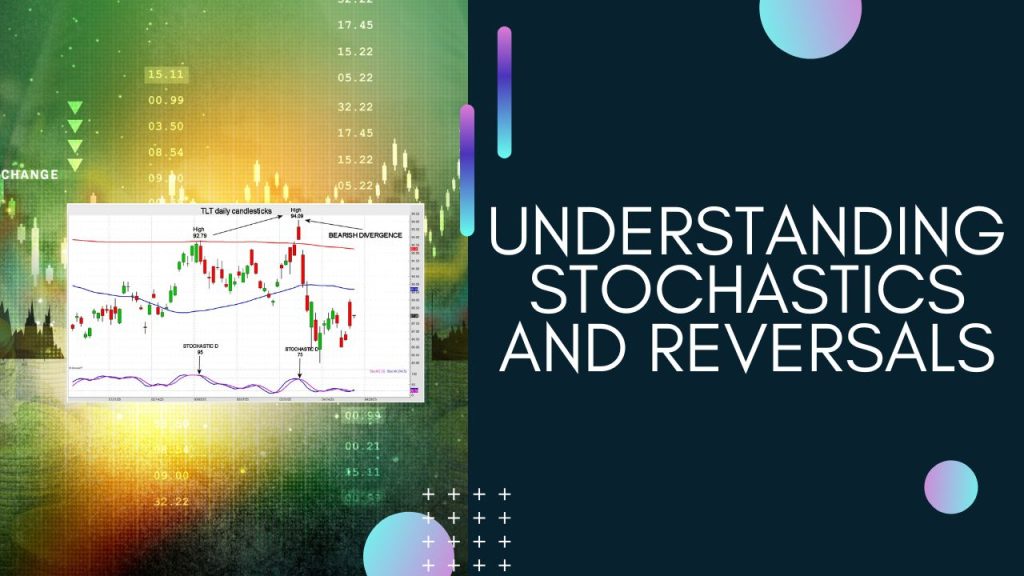

Understanding Stochastics and Reversals

There’s a common myth in trading: that RSI and Stochastics do the same thing. Not quite.

Are You Reviewing Your Trades?

Sometimes the best move is to do nothing and stay in cash. But that doesn’t mean sit idle. This is the perfect time to review your past trades.

Volatility Induces Anxiety

Economic uncertainty, trade tensions, geopolitical events and inflation have added considerable volatility to markets. There have been big swings in interest rates, which have a direct influence on equity indexes, currencies, precious metals and numerous commodities. In addition, automated trading systems can exacerbate rapid price changes during volatile periods. As volatility rises, so do risk and anxiety.

Your Naked Put Warning

With market volatility at extreme levels, option premiums are tempting—but don’t let that fool you. Selling naked puts can be a high-risk strategy, especially if things move against you.

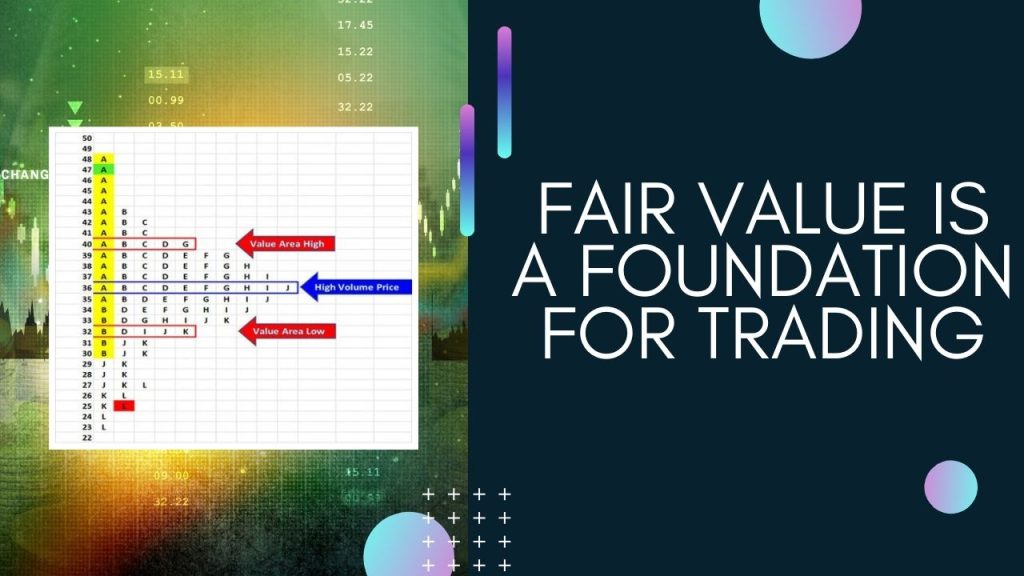

Fair Value Is a Foundation for Trading

Spend time with a broker or pit trader from the era when all trades were executed by brokers in trading pits at exchanges and you will learn about open outcry and the information it provides. Pits were created to facilitate trade. To an untrained eye a trading pit is a ring filled with angry, aggressive people wearing badges on various colored jackets. But for a seasoned observer a trading pit reveals incredible amounts of information not available on screens or trading platforms. Professional traders monitor order flow. They use a combination of market-generated information (technicals) and fundamentals (supply/demand or earnings) to define and refine strategies.

Reminder: Tighten Your Option Management

Have you noticed how volatile the market is and how it seems to gap almost every session at the open? Of course you have—unless you have been stuck under a rock. This post is a reminder that option management needs to be front and center at all times, and many times risk need to be taken off the table early.

The Monty Hall Dilemma and Opening Your Mind

The Monty Hall Dilemma is a classic thought experiment that trips up even the smartest people. The same kind of faulty intuition leads traders to make bad decisions every day.

A Sweet Bear Put in TSLA

In this post, we’re walking through a bear put trade in TSLA from late February, highlighting how spotting technical setups and choosing the right expiration can create an edge.

Lessons From the Futures Pits

Spend time with a broker or pit trader from the era when all trades were executed by brokers in trading pits at exchanges and you will learn about open outcry and the information it provides. Pits were created to facilitate trade. To an untrained eye a trading pit is a ring filled with angry, aggressive people wearing badges on various colored jackets. But for a seasoned observer a trading pit reveals incredible amounts of information not available on screens or trading platforms. Professional traders monitor order flow. They use a combination of market-generated information (technicals) and fundamentals (supply/demand or earnings) to define and refine strategies.

Psychology Is Key in Options Trading

You heard it here first: Psychology is key in options trading. Actually, you probably didn’t hear it hear first, but I bet when you did you didn’t believe it right away. To be honest, neither did I. When I started out as a retail trader, I had no idea how important psychology is to successful option trading. And even though I quickly learned this lesson, it took me several years to get a handle on it.