When markets begin to trend, they frequently do so with fast and furious moves. It’s important to track market correlation, price targets and profit potential. Quite often there are clues or patterns that occur prior to a breakout and just after one. It is a trader’s goal to recognize that critical moment when a directional trade or trend commences. Identifying a pre-trend pattern enhances the odds of catching a move early, also known as timing.

Trend Ignition

My previous blog focused on pre-trend setups for catching sharp vertical moves early. In this post I will concentrate on what the onset of a trend looks like and how to move trailing stops to lock in profits as the market moves in your favor.

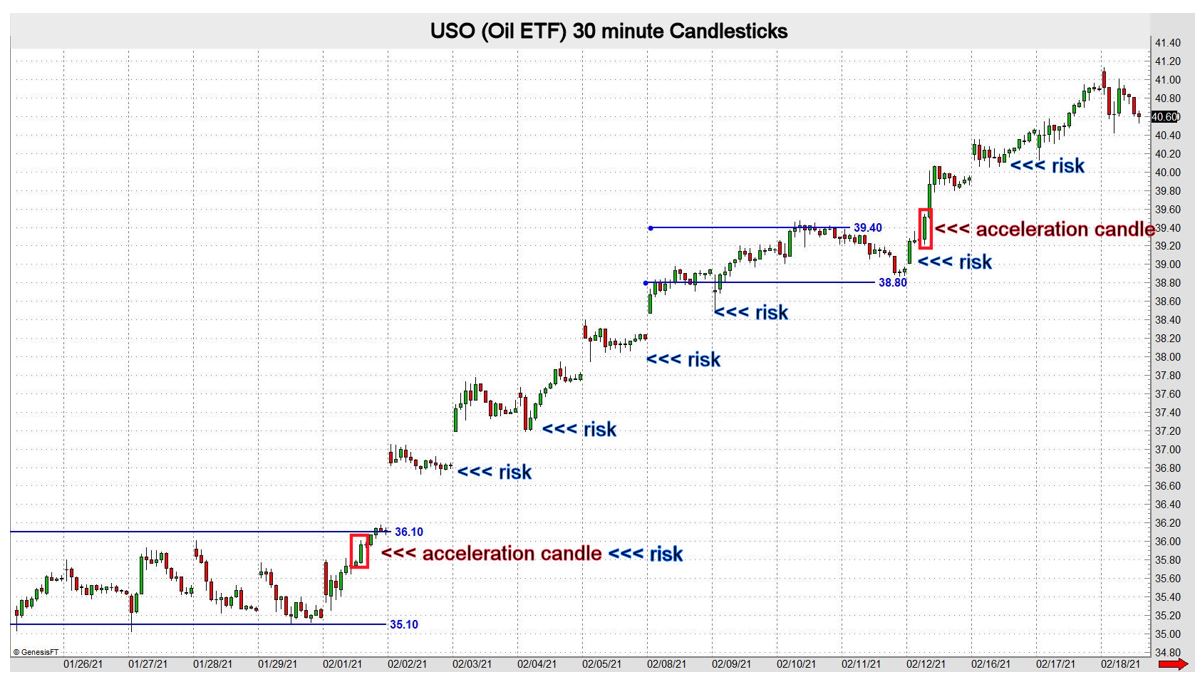

To increase profit potential and decrease risk, good timing is essential. At the beginning of a trend there is usually a certain type of candlestick or set of them. To find such candles I prefer viewing 30-minute charts; 60 minutes works too. These candles have long bodies, small wicks and little to no overlap of the next candle. Furthermore, the range (high-low) in that single candle tends to be above average.

The chart below shows a couple of examples of a pre-trend consolidation phase and that critical candle that ignited a vertical move. Recognizing this phenomenon will help you enter trends early, thus increasing profit potential while mitigating risk.

Identify Pivotal Prices

When a market moves in your favor it is vital to lock in profits while the trend progresses. No one knows how long or far a trend will extend. Therefore, it is a good practice to trail a stop order. Stop orders are designed to define risk and limit loss. But this type of order also allows the trader to realize profits using pivotal or critical prices.

For setting risk or trailing stops I frequently use highs, lows and acceleration levels. One of my favorite strategies after a long position is taken is to use the previous day low to define risk. I then trail or set my stop to the next day’s low during an uptrend. If riding a downtrend, I use the previous day high to trail a stop and secure profit.

The USO chart below shows how this technique can pay during an uptrend. In this example, a six-day trend occurred from the first breakout and that was followed by another four-day ride higher. When each mini trend started there was an “acceleration” candle. They have short wicks and long bodies and are an indication of power. A short wick, long-bodied green candle means bulls have taken command. A similar red candle indicates bear dominance.

Such candles form when a market breaks free from a consolidation phase. I recommend moving trailing stops to acceleration candles to lock in more profits. Charts reveal behavior. Our job is to identify when and where bulls or bear have gained control. Then use that information to hang with the trend or take the money and run.

John Seguin

Senior Technical Analyst

Market Taker Mentoring, Inc.