Have You Ever Thought About Modeling?

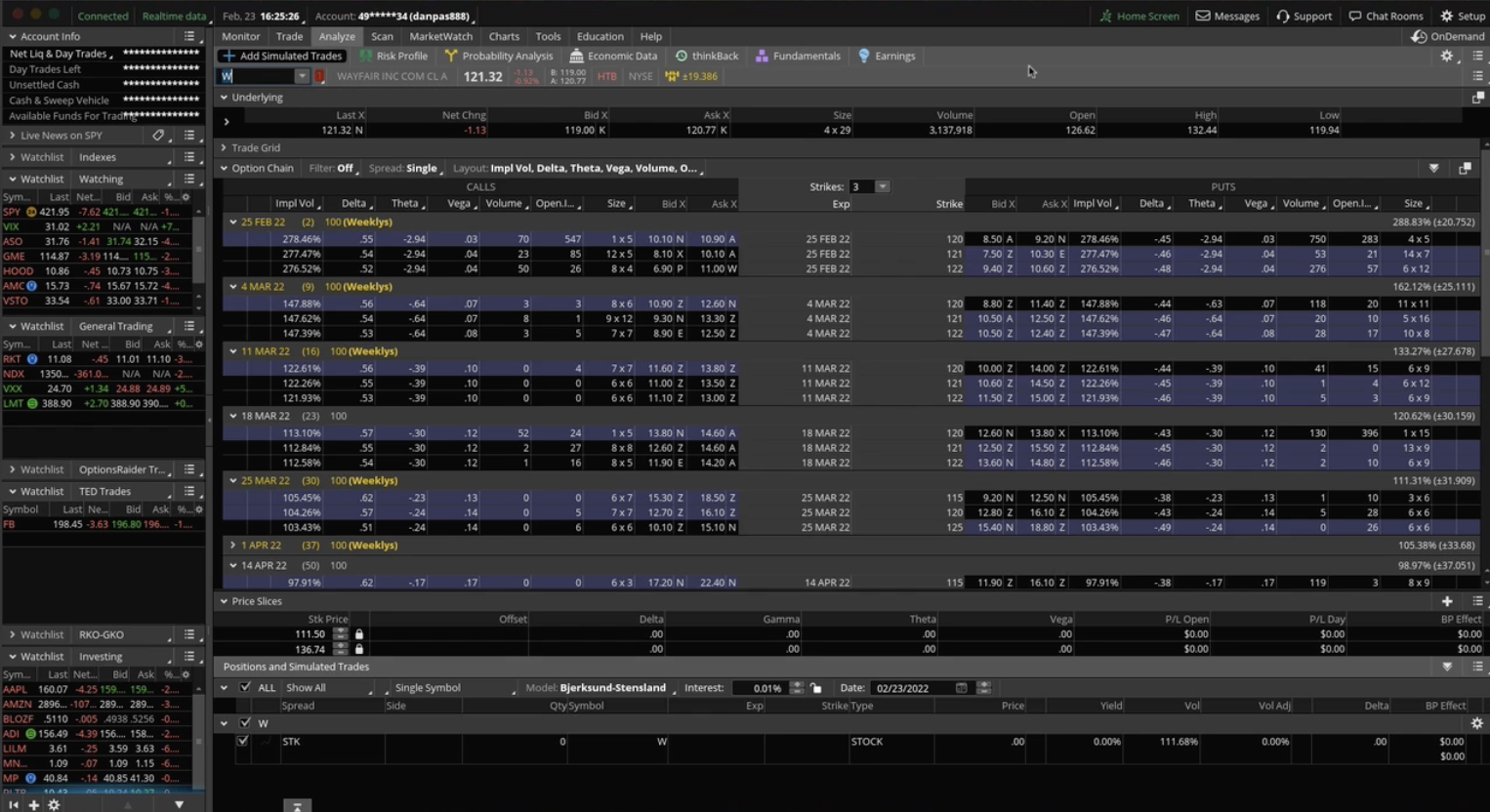

I was working with one of our student traders recently, and we spent a lot of time talking about modeling… trades, of course. Duh. Modeling option trades is an underused part of any proven trading methodology. I’d go as far as saying that trade modeling should literally be done on every single trade. It’s important […]

Love It or Leave It

A Netflix Calendar Spread That Required Patience

If you know a little about me when it comes to option trading, you know my adoration for time spreads and in particular calendar spreads. I look for them often in MTM’s daily group coaching class and of course for my own personal trading too. What I like about them is that they give an […]

A Green Knock Out in VSTO

Picking Up Straddles

Ukraine, Russia and Defense Stocks

Who Are Traders?

I like writing. I like giving options training presentations. I like talking to traders. I think what I like most about it is the connection. This kindred spirit connection we traders all have. And I was thinking about this last night. Well, this morning, I guess. (I was actually thinking about this around 4 am […]

How and Why I Use OCO Orders

Trading More Straddles and Strangles

We Set Two Records This Week

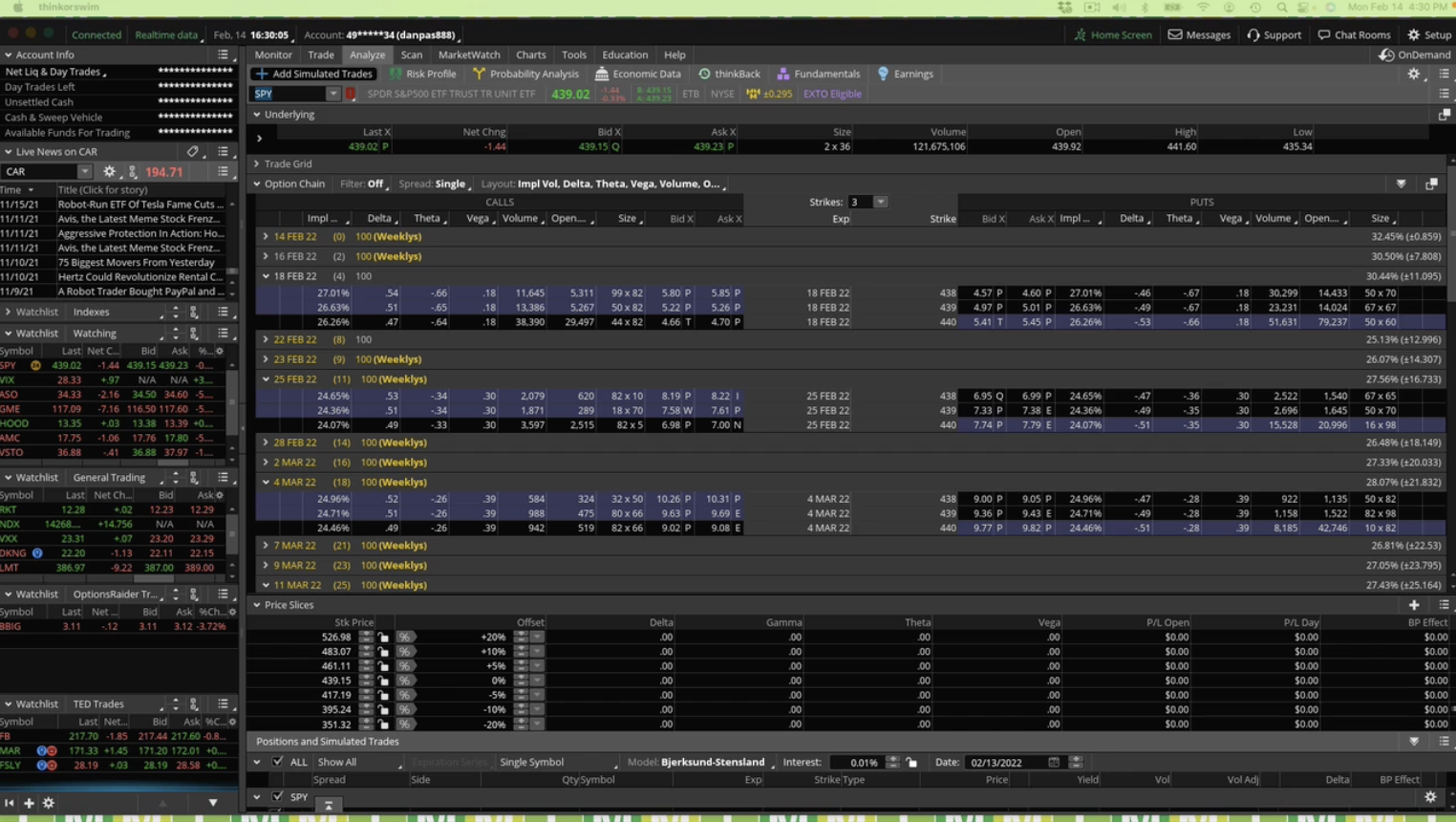

A Vertical Debit Spread on SPY

This past Monday in group coaching class, we looked at the S&P 500 ETF (SPY) for a potential vertical debit spread. At the time, the ETF was attempting to surge over some potential resistance from the 200-day moving average. When it did make the surge over the resistance level, it was a bullish opportunity as […]

After Hours Trading: Does It Really Matter?

How Gamma Squeezes Work (and why they are important)

How and Why to Trade Straddles

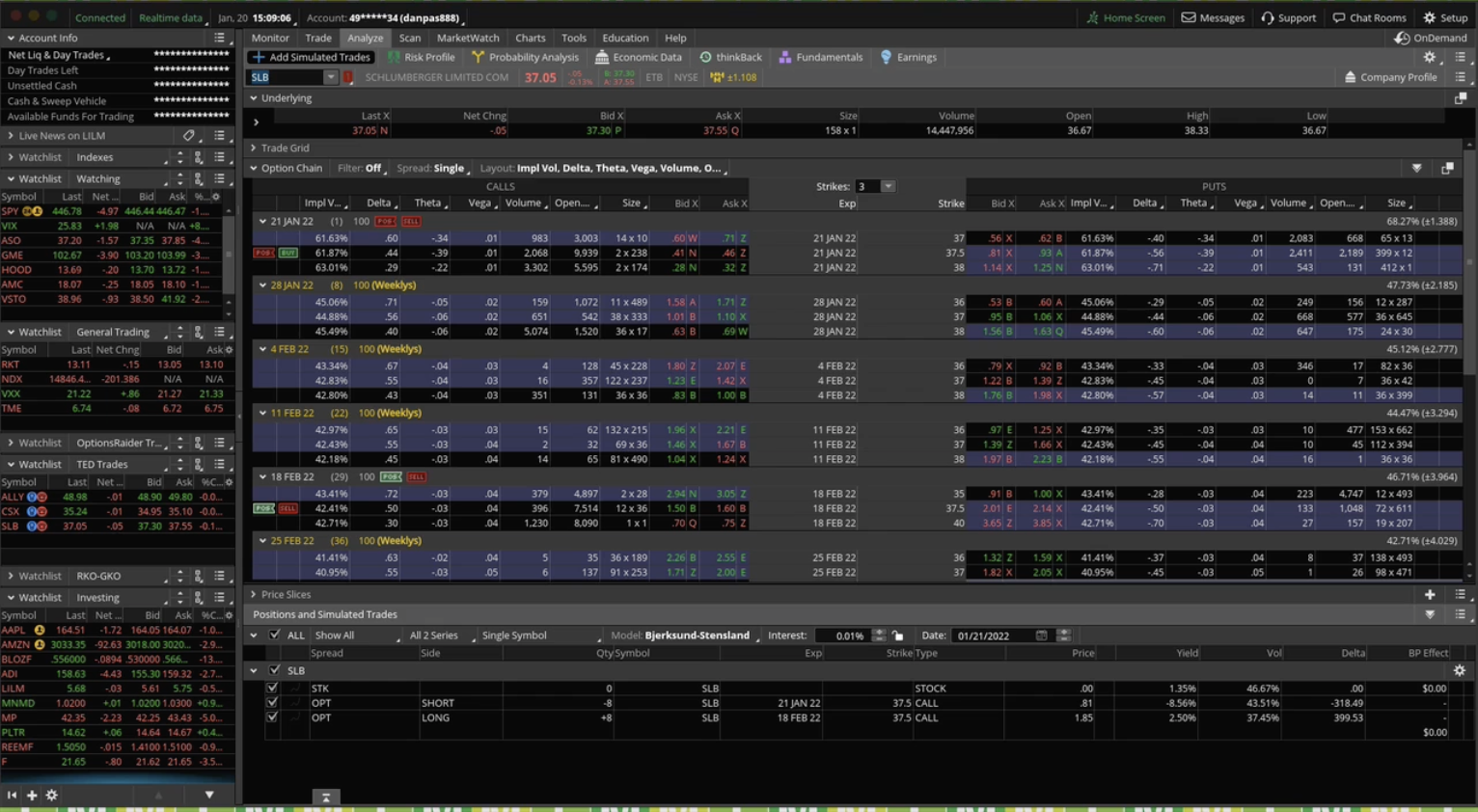

As Simple as Possible Is Not Always Simple

If you’ve been part of the Market Taker Family for a while, you’ve heard me say, “Keep your trades as simple as possible.” It’s sound advice. I stand by it. But… The simplest possible trade isn’t always a simple trade. I thought it would be fun to dissect a trade I made recently that was […]

Big Move Today in the Market: What’s Next?

Earnings Trading: Improving Your System [Special Invite]

Earnings Trading: Volatility NOT Direction

Is 2022 Your Option Trading Breakthrough Year?

Just like the beginning of any sports season with teams at 0 wins and 0 losses, there is optimism among option traders right now that this will be “the year.” Of course, if a sports team is not any good, we usually know what will happen. As an option trader who may have been struggling […]

Timing Earnings Trade Entries

Today’s Earnings Trades