How to Use Option Theta in Your Trading

Trading options can be a long and frustrating journey without discipline and solid understanding of the option greeks, including option theta, and how to use them in your trading. Most option traders know there is a time component to options. But surprisingly, many do not have a firm grasp of what that really means. Below […]

Build Traders Toolbox with Right Technical Tools

As an educator I make it a point to help students develop a solid fundamental and technical foundation. Years ago, I started my own “traders toolbox” that is now filled with facts, axioms, statistics and technical indicators. I refer to my toolbox when trading and creating strategies. My first experience in the markets was on […]

Best Iron Condor Strategies to Win as an Option Trader

Iron condor strategies involve combining two credit spreads or two debit spreads. While the strategies themselves are not complicated, managing the positions can be for option traders without the proper education. Iron condor strategies can be modeled out to be neutral or directional trades depending on the outlook. Trading iron condors can utilize your fundamental […]

Using Average True Range (ATR) to Boost Your Trade

Professional traders use logic and math to design strategies, and Average True Range (ATR) is a critical component. Traders often use ATR to boost profit projection as well as define risk. It is imperative to identify benchmark ranges (ATRs). This vertical indicator (high minus low) may reveal when a market has reached overbought or oversold […]

ATM, ITM and OTM Options Explained

There are three ways based on strike prices to buy and sell options with varying degrees. An option can be at-the-money (ATM), in-the-money (ITM) or out-of-the-money (OTM). But what makes an option ATM, ITM or OTM? Below we will answer that very question and show a few examples that should make the concept a little […]

Using VXX as a Portfolio Hedge

During the past couple of weeks, several people have asked me about using VXX as a portfolio hedge. Maybe people feel things are getting a little toppy with all the Fed intervention and the many other harbingers of potential danger hanging over the markets. I wanted to write about this subject because it’s pretty darned […]

Option Trading Success Secrets Unveiled

Are there such things as option trading success secrets? That can be debated, but what you should know is that there are ways to improve your odds for success in option trading. Are they necessarily a secret? Probably not. However, most option traders don’t do certain things that could enable them to extract money from […]

How to Use Moving Averages and Pivot Points in Trading

Moving averages are the most popular directional gauges. They are typically the first technical indicator in the novice trader’s toolbox. Many professional traders rely on them as well. Typically, the directional signals come when a short-term MA crosses a long-term MA. The problem with this method is that by the time the averages converge and […]

Option Gamma and How It Differs from Option Delta

Although it will always be debatable which is the most important option greek, many option traders point to option delta. This is understandable, considering most new option traders become acquainted with delta first. However, you cannot dismiss option gamma, which is sometimes referred to as a derivative of a derivative. Option Delta and Option Gamma […]

ETF or Exchange Traded Fund Option Trading Strategies

Futures traders have access to markets nearly around the clock. Stock and exchange traded fund (ETF) traders must deal with gaps in time and price when there is no market to trade or a huge drop in liquidity of those markets that do trade overnight. When liquidity is low, bid ask spreads are too. Entering […]

Option Delta – A Comprehensive Guide for Traders

Option delta is probably the first option greek many option traders learn. When I first heard and learned about the power of options, I was intrigued. Instead of buying shares of stock I could purchase a call for far less money and profit if my outlook is correct? Sign me up! There are other greeks […]

Stop Loss Orders and Options for a Profitable Trade

As traders we endeavor to catch a trend early and hold that position until an objective or target price is met. Catching a trend is difficult enough; squeezing the last dollar out of a trade is even harder. Stop loss orders are used to set risk. As another option they can also be used to […]

Butterfly Spread Trading Strategy Explained

An option butterfly spread trading strategy is very versatile because it can be used in multiple ways to potentially profit and also remove or reduce risk. As usual, it is nice to have options with your option strategies. Below we will talk about how to create a butterfly spread and how time decay is a […]

Track Market Correlation, Price Targets and Profit Potential

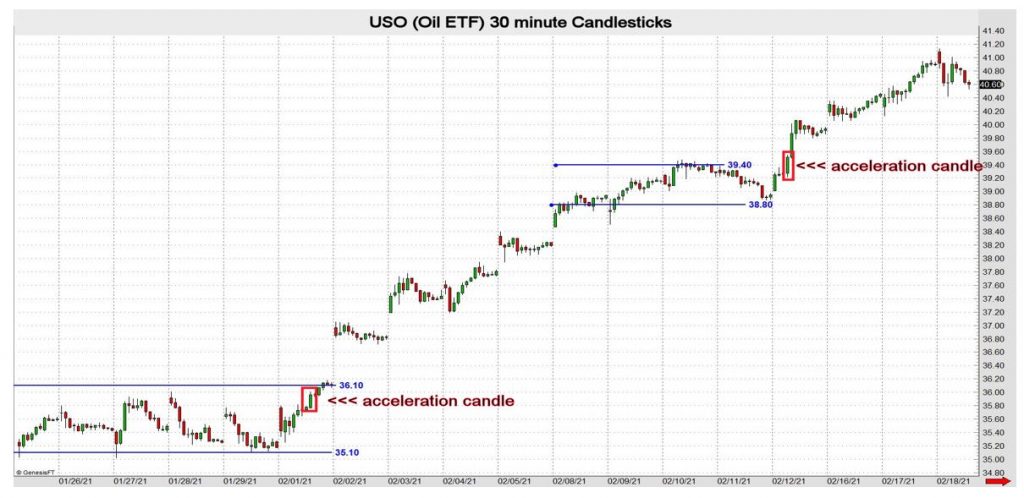

When markets begin to trend, they frequently do so with fast and furious moves. It’s important to track market correlation, price targets and profit potential. Quite often there are clues or patterns that occur prior to a breakout and just after one. It is a trader’s goal to recognize that critical moment when a directional […]

Your Option Greeks Quick Reference Guide

Knowing and understanding the option greeks is pivotal for your potential or continued success as an option trader. Listed below are some of the finer points of delta, gamma, theta and vega. Realistically, each could have its own book explaining how it works and its ramifications, but in this options greeks quick reference guide we […]

How to Identify Market Trends and Catch Them Early

To recognize market trends early is every trader’s ambition. The earlier you catch a trend, the more profit potential grows and risk decays. Timing this phenomenon requires a breakout strategy. Entry at the beginning of a sharp vertical move (trend) is the goal. Breakout Setup Timing is the ideal entry price and moment to enter […]

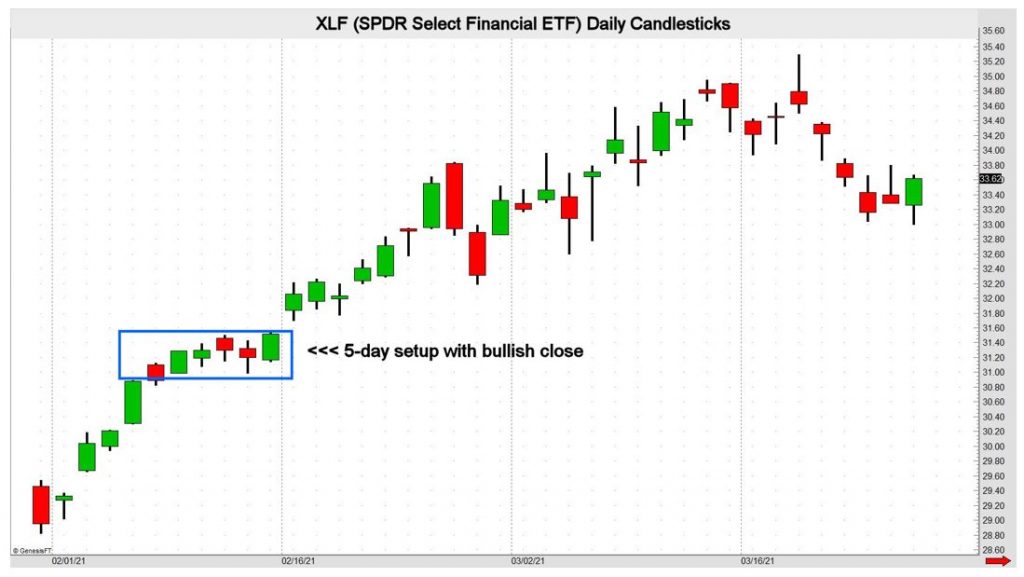

Bullish Bases – What Do You Need to Know?

Technical analysis can be a big part of your potential success even as an option trader. I truly believe this and talk about technical analysis every single day in my Group Coaching class. A lot of my education focuses on support and resistance. Often a stock needs to move above resistance (if there is any) […]

Technical Analysis and Indicators to Gain Edge

Technical analysis is using history to forecast the onset of a trend or determine when a trend is nearing an end. Technical analysis and indicators are also used to improve entry and exit levels. Fundamentals, or the forces of supply and demand, earnings, inflation, weather etc., move markets. Technical analysis is most useful when fundamental […]

Outright Call Options and Put Options – All You Need to Know

A topic that is brought up more often than you might think in my Group Coaching class is buying outright call options and put options. When option traders first learn about trading options, they often only consider buying call options for a bullish outlook and put options for a bearish outlook. I know I did […]

These Work-From-Home Stocks Will Continue to Climb Even After COVID

One of the big stock market stories of 2020 was the domination of so-called Work-From-Home Stocks. While some companies lost massive share value last year, these work-from-home stocks skyrocketed. But what happens after COVID? Can some of these stocks continue to climb? I think they can. To understand why, let’s take a trip through innovation […]

Trading Options and Cash-Secured Puts Over Earnings

With the next round of quarterly earnings just about to start, it is a good time to take a look at trading options and in particular cash-secured puts. Option prices (implied volatility levels) tend to increase around an expected earnings report. This could be potentially good (if traded correctly) for premium sellers and not so […]