Think of Adjustments as Brand-New Trades

This question comes up often in group coaching class and in my one-on-one option coaching sessions: How do you feel about adjustments? I personally do not have a problem with adjustments, but I often tell my students to think of them as brand-new trades. But that’s the problem. Most option traders cannot think clearly and […]

Motivation as an Option Trader Is Key

I bet you are motivated to make money as an option trader. Am I right? But are you willing to do the things that can allow you to make money consistently over time? If you are new to trading or have been trading for several years without the success you envisioned, it might be time […]

It’s a Brand-New Option Trading Year

Call it a brand-new year. Call it a New Year’s resolution. It does not really matter what you call it as long as you do something different from what you have tried before. What I am talking about is improving your options trading starting now. With 2022 almost out to pasture, it is time to […]

Take a Trading Break for the Holidays

The holidays are crazy for most people, and some might say the market is crazy right now as well. Whether or not you think the latter is true, the one thing that is for sure is you sometimes need to take a break from trading. The holidays are a perfect time. I have written several […]

Volatile Events Can Produce Volatile Days

After looking at the title of this post, you are probably thinking, “well, of course they can produce volatile days.” While we often know things like this as traders, our emotions can take over and common knowledge sometimes go out the window. This is just a reminder to keep the emotional trader inside you in […]

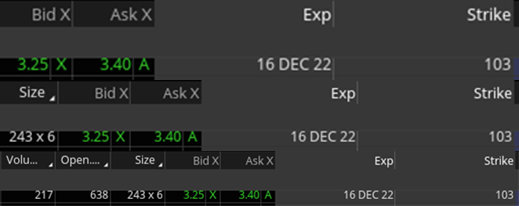

How to Measure Options Liquidity

Before we even think about thinking about how to measure options liquidity, we need to talk about what option liquidity is. Liquidity is a term traders love to throw around, but SO MANY traders don’t fully grasp the concept. They look up online how to measure it and often get some bad guidance that doesn’t […]

Be on the Side of the Market

If you know anything about me, you know how much I look for support and resistance areas on charts to help give me an edge. Just recently, the S&P 500 ETF (SPY) was challenging a resistance level. The market had rallied at the beginning of November, and around mid-month the SPY was trying to move […]

Basic Options Strategy (and More)

I was sitting on a plane to Vegas earlier this week thinking about what is most important for option traders, and I ended up having one of those moments of clarity. The best basic options strategy is to follow the rules (see side note at bottom). Basic Strategy in Blackjack If you play blackjack and […]

A Credit Spread on CRM

When looking at a chart, I often tell my group coaching students to ask themselves what has a better chance of happening. What I mean by this is that if there is any potential support or resistance, a trader can use it as a proxy for what is more likely to happen. In short, support […]

Most Important Trading Data: CPI vs. PCE

We saw a pivotal Fed Announcement this week. It may be the end of the 75-basis-point parade that’s been waltzing down Wall Street for a good part of this year. We’re now starting to see varying thoughts of what the Fed will do next, and not just from outlier accounts on Twitter, but from trusted […]

Not the Best Time for a Vertical Credit

Vertical credit spreads are a popular option strategy for a reason. They give an option trader a high probability of a profit, especially when the spread is initialized out-of-the-money (OTM). Who does not like a nice probability on an option trade? I always say you have 3 out of 4 ways to make money. The […]

Stop Always Thinking Bullish Trades

Here is a quick but important post about remembering what type of market we are facing and why many traders always think about bullish trades…even when the market is heading south. Let’s face it, it has been a less than stellar bullish year thus far. That said, many traders are still primarily looking for bullish […]

IV and a Double Calendar on SPY

Recently in MTM’s Group Coaching class, we talked about a long double calendar on SPY. The interesting part about the conversation was that Fed Chair Powell was speaking the next day at the Jackson Hole Symposium. A volatile day might ensue the next session. Implied Volatility Skews At the time we were looking at the […]

Greeks of Directional Time Spreads

We’ve been seeing a lot of time spreads trading lately. A LOT. And one variety of time spread I’d always been a fan of—directional time spreads—I’ve become just stark raving mad of a fanatic about recently. Directional Time Spreads Why trade directional time spreads? As I like to say, it’s not just about probability of […]

Option Trades for a Neutral Outlook

As we continue our look at option strategies based on the expected move or non-move, today we’ll explore a neutral outlook. The beauty of options is they allow option traders to profit when there is a neutral bias. Trying to do that with a stock position, for example, is a bit difficult. Neutral Having a […]

An Options Trading Routine Is Smart

I often harp on traders to have a written trading plan. Without one, in my opinion, they won’t have much chance of being successful in the long run. One of the many reasons to consider a trading plan is to formulate a routine for yourself. Following a routine you are comfortable and successful with is […]

Option Trades for a Bearish Outlook

Several weeks ago, we looked at option strategies for a bullish forecast for the market, underlying or both. Today we will explore a couple of option strategies for a bearish outlook. As we did previously, let’s consider a few examples of a bearish outlook either for the market or an individual underlying. Bearish The three […]

How to Do Sector Analysis

I’m sometimes asked by a student trader how to do sector analysis in your trading. This is a broad topic and there are many, many different ways to skin this cat. Lately, I’ve been using it in a very specific way. Let’s first talk about sector analysis, meaning how I use it, and then a […]

Option Trades for a Bullish Outlook

Today we will explore a couple of option strategies for a bullish outlook. Before we get started, let’s take a look at a few examples of what may be considered a bullish outlook, either for the market or an individual underlying. Bullish The three most bullish opportunities in regard to technical analysis are a stock […]

Support and Resistance Are Your Edge

Over the past several months, this market has been tough to navigate as a swing trader, in my opinion and based on discussions with other traders. But despite so-called difficult market conditions, traders can always look for an edge, and that edge can be support and resistance. Better Chance to Hold As I say frequently […]

Comparing Bearish Vertical Credit Spreads

Vertical spreads offer an option trader a wide variety of risk/reward scenarios. As I like to say, there are options on your options. Maybe more importantly, there are trade-offs when it comes to options and the different strategies that can be used and vertical spreads are no different. Many new option traders tend to stay […]